BUSINESSNEWS

VALUE

VALUE

VALUE

VALUE12

12MTH

CURRENCY

ATSTART

ATEND

CHANGE

%CHANGE

MTHSAGO

%CHANGE

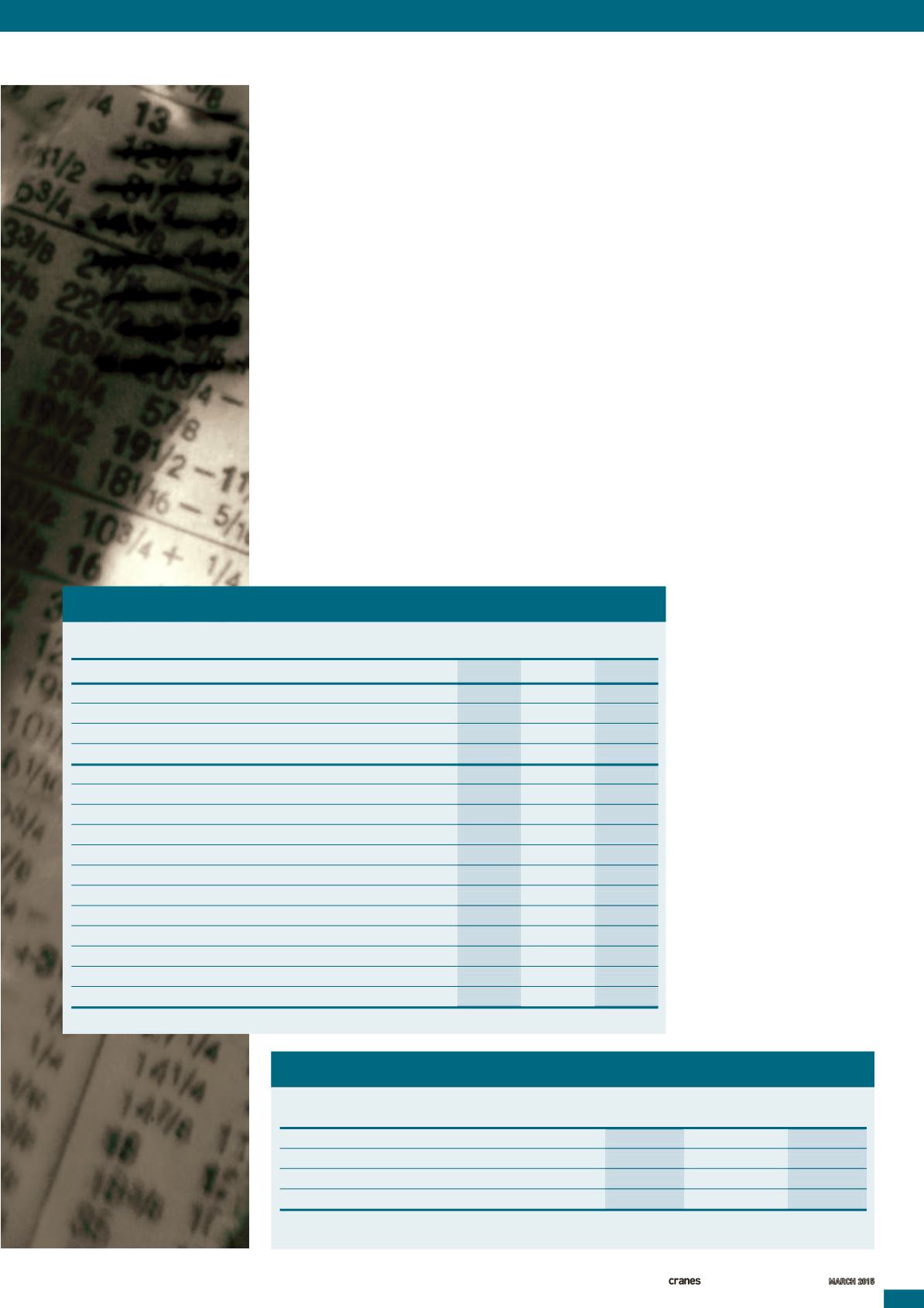

CNY

6.248

6.270

0.0222

0.36

6.06

3.46

€

0.8815

0.8913

0.0098

1.11

0.7376

20.84

Yen

117.77

119.31

1.53

1.30

102.51

16.39

UK£

0.6630

0.6497

-0.0133

-2.01

0.6119

6.18

Period:Week5-9

13

INTERNATIONAL

ANDSPECIALIZED TRANSPORT

■

MARCH 2015

Continued rally

high, eclipsing theprevious

one set in1999, and the

Nikkei 225grew6.36% to a

15-year high.

Cranemanufacturingwas

pulledalongby this,with the

IC

Share Indexmanaging

tooutstrip thegainsof the

mainstream indexeswitha

7.76% rise invaluebetween

weeks 5and9.All the

companieswhichmakeup

the Index saw their shareprices

rise invalue inFebruary, and

manymanufacturers enjoyed

double-digit gains.

This all seemed tobe

aproduct of thegenerally

buoyant economicoutlook.

Themain component of

this is the lowoil price,which

is expected tobe a significant

Crane

manufacturers’

shares continued

to rally inFebruary,

against theusual

seasonal run of

things. CHRIS

SLEIGHT reports

stimulant to economies

around theworld, particularly

those likeEuropewhichare

net importersof oil and

where energy costs are

relativelyhigh.

Stimulation

Akey forEurope is the

quantitative easing (QE)

announcedby theEuropean

Central Bank in January; this

should stimulate the economy

andhas already triggered

depreciation in theEuro.

This isoneof the reasons

why shares for companies

headquartered in theEuro zone

havebeenparticularly strong

this year. It has also lifted share

indicators in the currencybloc,

includingGermany’sDAXand

France’sCAC40.

As it stands, thesepositives

seem tobeoutweighing the

negatives that doggedmarkets

last year.

It remains tobe seenhow

these factorsplayout this

year.While the fall inoil

prices is generallypositive

formajordeveloped economies

suchasEurope, Japanand the

USA, it isnot universal good

news andwill cause aproblem

for countrieswhich relyon

oil andother energy exports.

Obvious examples include the

Organisationof Petroleum

ExportingCountries (OPEC),

andRussia,whichwas

already suffering the impact

of sanctions.

So it remains tobe seen

whether the economic and

sharepricegrowthwill be

sustained, ornegativenews

will burst thebubble.

■

A

round late January

or earlyFebruary it

is common for share

prices to take a sharpdip,

following the rallywhich

usually starts in the run-up to

the endof the previous year.

It often seems asmuchdue

tohumanpsychology as hard

economic data, as the ‘feel

good factor’ ofChristmas and,

perhaps, the incentive of

year-endbonuses, sees share

prices rise, only for them to

tumble in January.

The trendhas yet to

materialise,with shareprices

continuing to climb through

January andFebruary. In

February theDowwas up

4.58%,while theFTSEgained

2.05% to set anew record

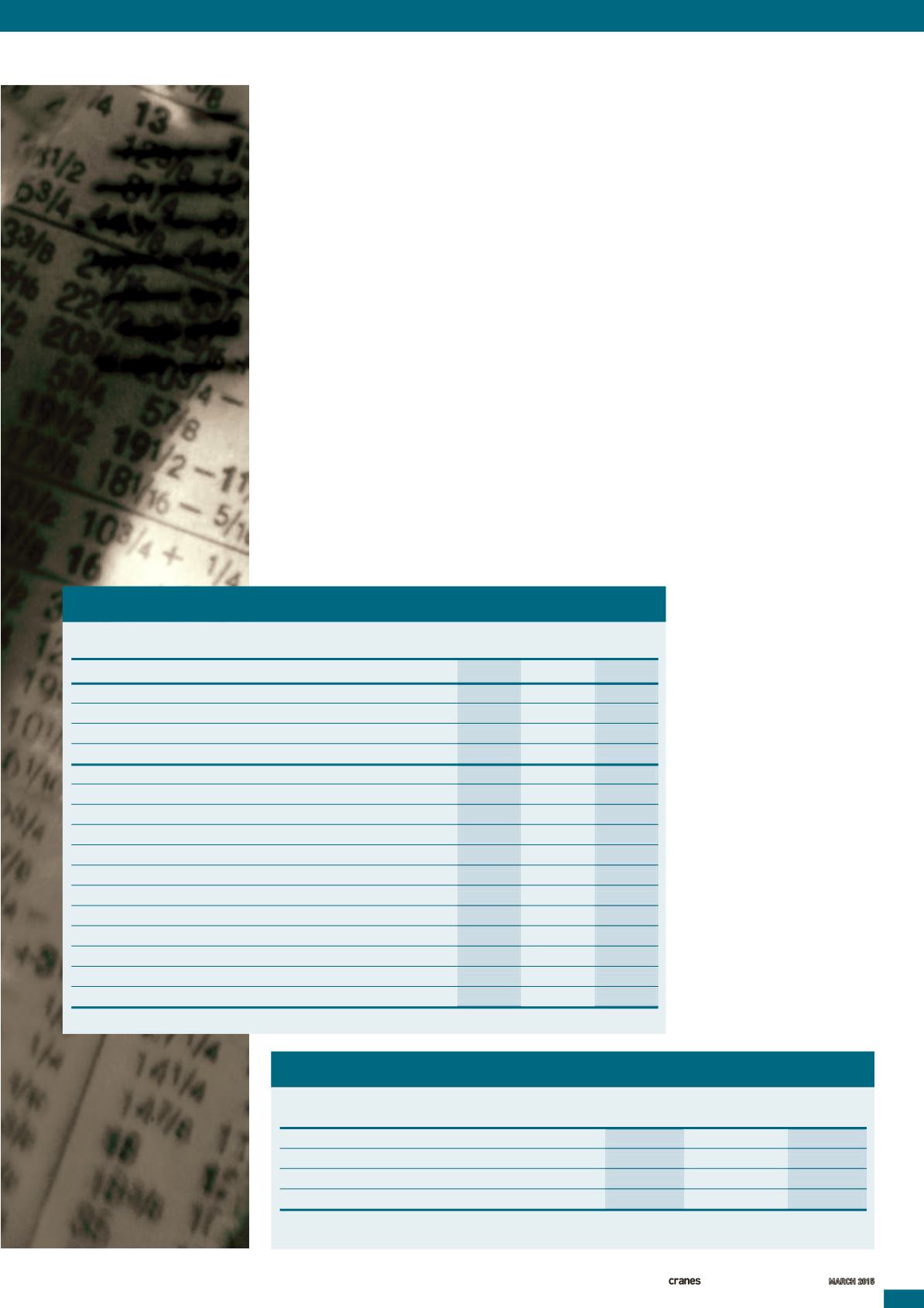

MARCH ICSHARE INDEX

EXCHANGERATES – VALUEOFUS$

PRICE

PRICE

PRICE

%

PRICE12

12MTH

STOCK

CURRENCY ATSTART ATEND CHANGE CHANGE MTHSAGO %CHANGE

IC

Share Index*

68.05 73.33

5.28

7.76

63.65

15.21

Legacy ICShare Index**

329.89

364.27

34.38

10.42

393.23

-7.37

DowJones Industrial Average

17417

18214

798

4.58

16273

11.93

FTSE 100

6808

6948

139

2.05

6804

2.11

Nikkei 225

17674

18798

1124

6.36

14841

26.66

Hitachi ConstructionMachinery YEN

2202

2213

11

0.50

1974

12.11

Konecranes

€

26.90

30.93

4.03

14.98

25.54

21.10

KobeSteel

YEN

208

236

28

13.46

139

69.78

Liugong

CNY

10.29

11.35

1.06

10.30

5.81

95.35

Manitowoc

US$

19.24

22.11

2.87

14.92

30.98

-28.63

Palfinger

€

22.78

26.05

3.27

14.35

29.06

-10.36

SanyHeavy Industry

CNY

8.14

8.52

0.38

4.67

5.75

48.17

Tadano

YEN

1431

1549

118

8.25

1319

17.44

Terex

US$

23.04

27.37

4.33

18.79

44.14

-37.99

XCMG

CNY

11.87

13.50

1.63

13.73

6.95

94.24

YongmaoHolding

SGD

0.14

0.20

0.07

48.15

0.21

-4.76

Zoomlion

CNY

6.12

6.26

0.14

2.29

5.00

25.20

*

IC

Share Index, 1 Jan2011 = 100

**Legacy

IC

Share Index, endApril 2002 (week 17) = 100