BUSINESS NEWS

13

INTERNATIONAL AND SPECIALIZED TRANSPORT

■

OCTOBER 2013

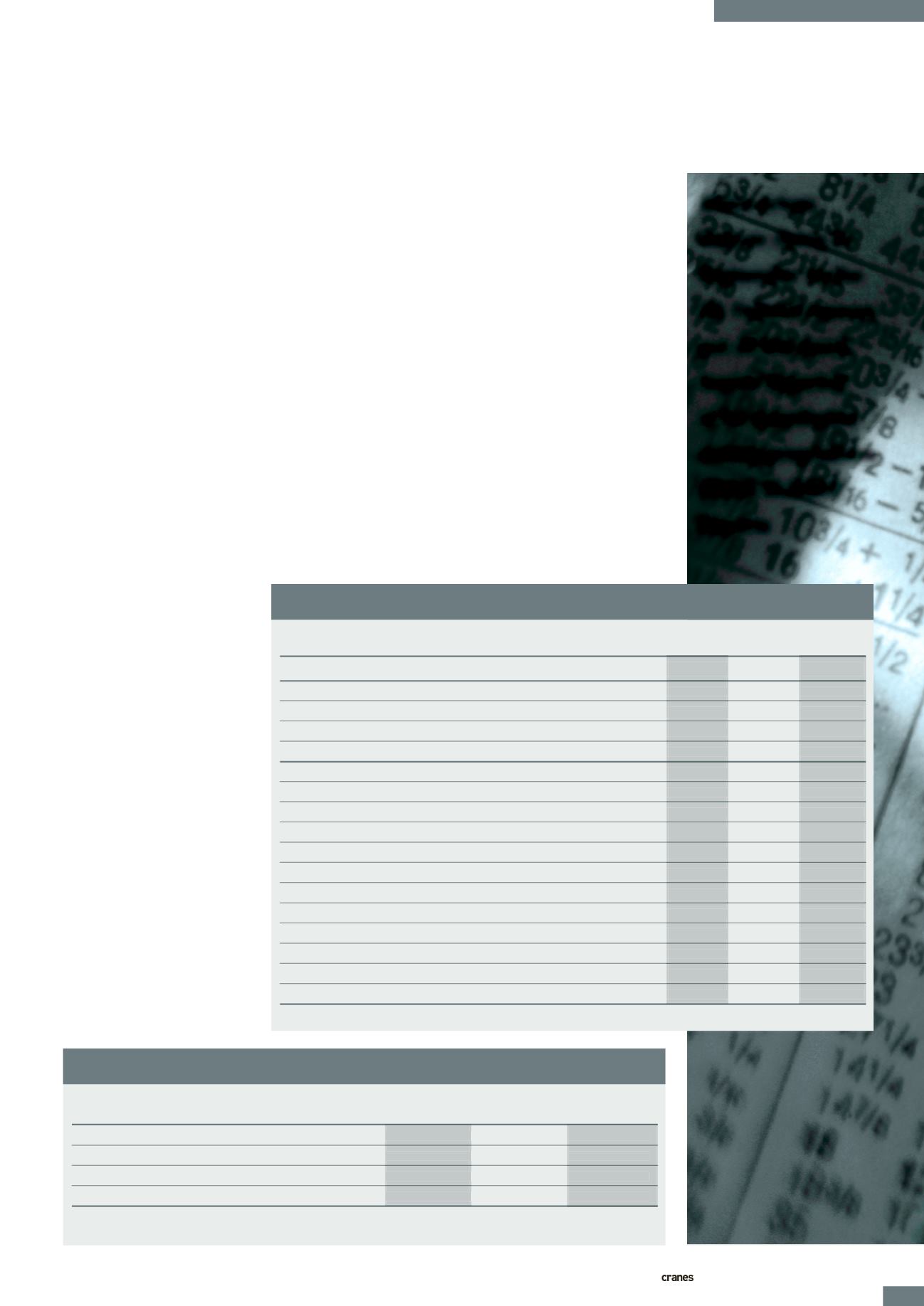

STOCK

CURRENCY

PRICE

PRICE CHANGE

%

PRICE 12

12 MTH

AT START AT END

CHANGE MTHS AGO % CHANGE

IC

Share Index*

57.08 61.07

3.99

6.99

56.27

8.53

Legacy IC Share Index**

344.13

369.00

24.86

7.22

229.38

60.87

Dow Jones Industrial Average

14964

15328

364.56

2.44

13485.97

13.66

FTSE 100

6433

6542

108.52

1.69

5803.63

12.72

Nikkei 225

13661

14760 1099.52

8.05

8870.16

66.40

Hitachi Construction Machinery YEN

1997

2244

247

12.37

1263

77.67

Konecranes

€

24.18

25.39

1.21

5.00

22.90

10.87

Kobe Steel

YEN

161

185

24

14.91

62

198.39

Liugong

CNY

6.12

6.73

0.61

9.97

8.66

-22.29

Manitowoc

US$

21.17

19.47

-1.70

-8.03

13.53

43.90

Palfinger

€

25.50

26.80

1.30

5.10

17.00

57.62

Sany Heavy Industry

CNY

7.08

7.49

0.41

5.79

9.60

-21.98

Tadano

YEN

1440

1320

-120

-8.33

591

123.35

Terex

US$

30.97

34.09

3.12

10.07

22.74

49.91

XCMG

CNY

7.75

8.20

0.45

5.81

10.65

-23.00

Yongmao Holding

SGD

0.21

0.21

0.00

0.00

0.08

146.99

Zoomlion

CNY

5.17

5.61

0.44

8.51

8.62

-34.92

*IC Share Index, 1 Jan 2011 = 100

**Legacy IC Share Index, end April 2002 (week 17) = 100

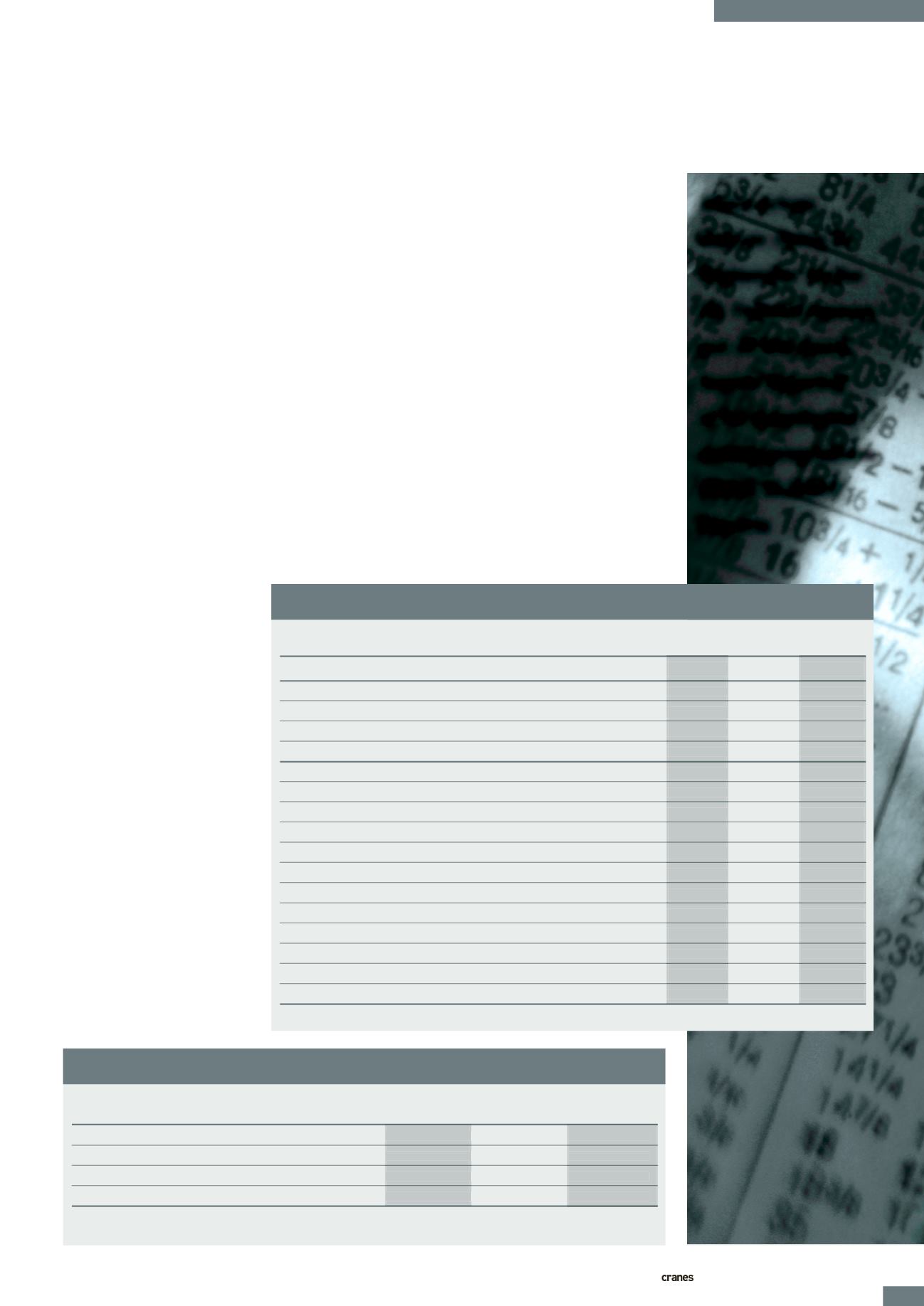

OCTOBER IC SHARE INDEX

CURRENCY

VALUE

VALUE

CHANGE

% CHANGE

VALUE 12

12 MTH

AT START

AT END

MTHS AGO

% CHANGE

CNY

6.1214

6.122

0.0006

0.01

6.288769

-2.65

€

0.7496

0.7409

-0.0088

-1.17

0.7728

-4.14

Yen

98.93

98.59

-0.34

-0.34

77.56

27.11

UK£

0.6496

0.6408

-0.0088

-1.35

0.6159

4.04

Period: Week 34 - 39

EXCHANGE RATES – US$

Tapering relief

suggests, it was a good period

for all the shares that make up

the Index, with all companies

in the industry apart from

Tadano seeing a gain.

In contrast, other Japanese

manufacturers were among

the strongest gainers over the

course of the month. Kobe

Steel was up nearly 15 %

between weeks 34 and 39,

while Hitachi was up more

than 12 %. The only other

company in the

IC

Index to

see a double-digit gain was

Terex, although Liugong was

not far off.

However, as

IC

went to

press, the good news about

QE looked as if it could be

offset by the US Government

shutdown, as the two sides

Share prices

kept on rising in

September as the

US Federal reserve

put off the much

feared ‘tapering’

of its quantitative

easing programme.

CHRIS SLEIGHT

Reports

of the house squabbled over

budgets and the debt ceiling.

Needless to say, this avoidable,

politically manufactured crisis

is something the markets

could do without, and is

particularly ill-timed given

the tepid economic growth

being seen around the world

this year.

Impact damage

It remains to be seen what

impact this will have on the US

economy or the psychological

damage it could inflict on

markets. The shutdown is also

likely to further weaken the

US Dollar, which has already

fallen over the last 12 months

against both the Euro and

Chinese Yuan.

■

T

he statement from the

US Federal Reserve

in mid-September

that it would continue with

its quantitative easing (QE)

stimulus programme gave

stock markets around the

world fresh impetus.

Prior to the Fed’s

announcement on 18

September, there had been

concerns that it would

start to wind down the QE

programme, which currently

sees it buy up bonds and other

assets at a rate of some US$ 85

billion per month. Chairman

Ben Bernanke, however, said

he would delay the so-called

‘tapering’ of QE because

unemployment was still high,

congress was squabbling over

forthcoming budget deadlines

and mortgage rates were rising.

Although markets will have

to come to terms with the

gradual turning-off of the QE

tap at some point, September’s

news provided something of a

boost. The Dow jumped back

above the 15,000-point mark

to finish week 39 at 15,328

points, a 2.44 % improvement

on its position from five

weeks earlier.

Promising gains

The FTSE 100 was more

subdued with a 1.69% rise,

but the Nikkei 225 was up

8.05 % and it was also buoyed

by the news that Tokyo had

been selected to host the 2020

Summer Olympics.

The

IC

Share Index also

rose between weeks 34 and 39,

with a 6.99 % gain to take it

to 61.07 points. As this figure