FINANCE

13

CONSTRUCTION EUROPE

SEPTEMBER 2014

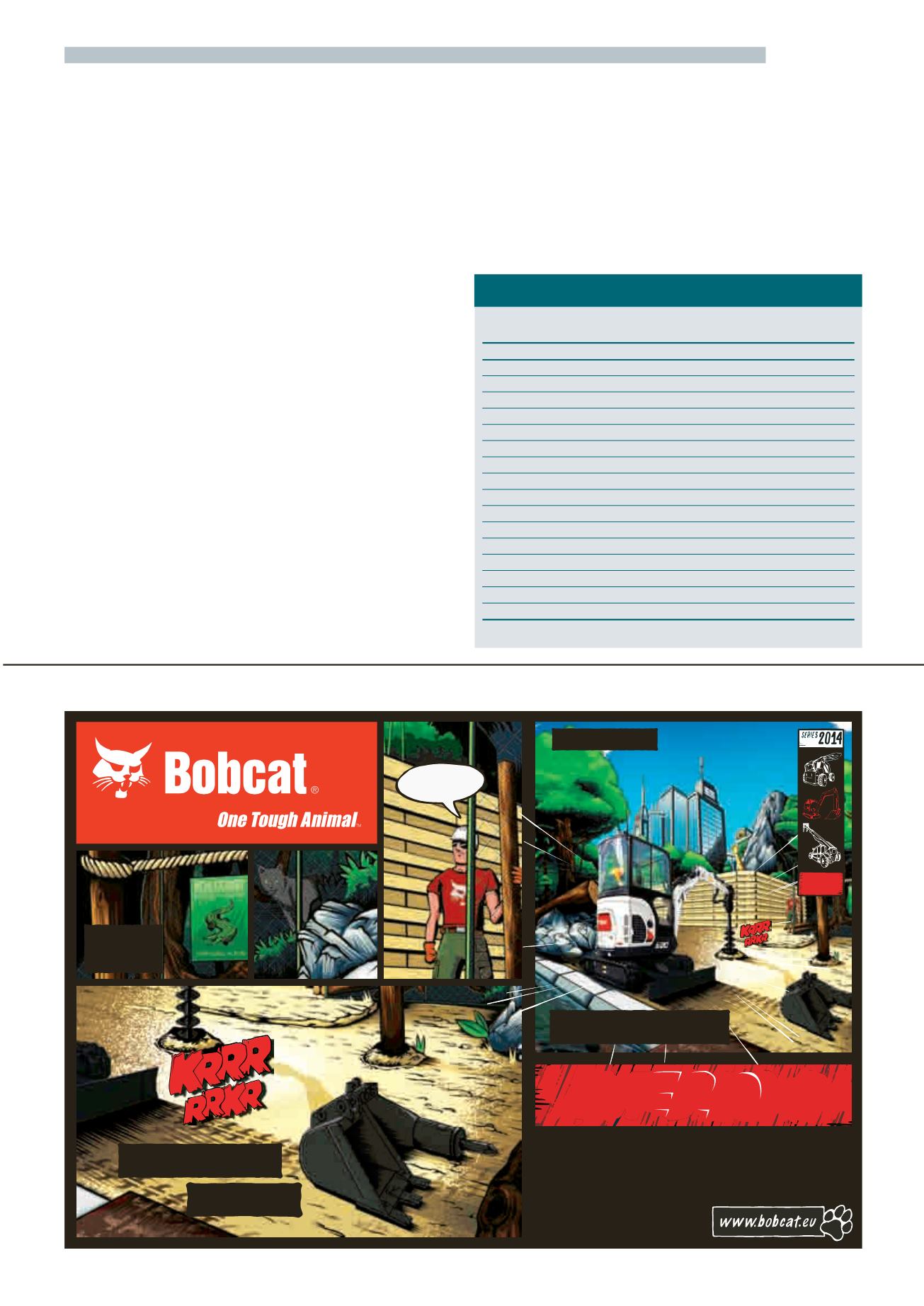

Company

Currency Price

Price Change Change

at start at end

(%)

CEM Index

162.82 157.39 -5.43

-3.33%

Buzzi Unicem (Ord)

€

12.60

11.53

-1.07

-8.49%

Cemex (CPO)

MXP

17.36

16.95

-0.41

-2.36%

Cimpor

€

2.63

2.24

-0.39 -14.83%

CRH

€

18.98

17.51

-1.47

-7.74%

Heidelberg Cement

€

60.21

57.03

-3.18

-5.28%

Holcim

CHF

78.40

73.55

-4.85

-6.19%

Italcementi

€

6.53

5.51

-1.02 -15.56%

Kone (B)

€

30.32

32.46

2.14

7.06%

Lafarge

€

63.51

58.45

-5.06

-7.97%

Saint-Gobain

€

38.12

38.37

0.25

0.67%

Schindler (BPC)

CHF

134.00 132.70

-1.30

-0.97%

Schneider Electric

€

66.96

64.59

-2.37

-3.54%

Titan Group (Common)

€

22.00

20.35

-1.65

-7.50%

Vicat Group (Common)

€

59.59

55.60

-3.99

-6.70%

Wienerberger

€

12.50

11.37

-1.13

-9.04%

Wolseley

UK£

31.89

32.32

0.43

1.35%

Period: Week 28 - 34

MATERIALS PRODUCERS

The company has seen two

CEOs resign since the start of

January 2013 because of profit

warnings, so it has a lot to prove.

The materials sector also saw

some heavy losses in late July

and August, with the CEM Index

falling 3.33%.

Most of the companies that

form the index saw their share

such as bonds and asset-backed

securities. This would increase

the supply of money in the

financial system and hopefully

push prices up.

MARKET PERFORMANCE

Although Eurozone deflation is a

serious global economic threat,

the market reaction was not as

bad as it could be.

From weeks 28 to 34, the Dow,

FTSE and Nikkei 225 were all

up. However, the worries clearly

weighed heavier within the

Eurozone, with both the CAC 40

and DAX losing ground.

The construction sector was

down over the same six-week

period, with the CET Index for

the whole industry losing 1.95%

of its value – about in line with

losses on the German and French

bourses.

The heaviest loss was for

contractors’ shares, with the CEC

Index for this sector losing 3.88%

of its value between weeks 28

and 34.

There were a number of

companies that saw double-digit

falls – Astaldi, Ballast Nedam,

Bauer, Bilfinger, FCC, OHL, Salini

Impregilo and YIT. In some cases

this was a result of poor half-year

results.

Indeed, in Bilfinger’s case, a

trading statement warning of

weaker than expected profits was

enough to prompt Ronald Koch,

the chairman of the executive

board to resign.

Among the few companies that

saw their share prices rise over

the six-week period were Balfour

Beatty and Carillion, which was a

result of the on/off merger talks

between the two companies.

The fact that the two companies

were in talks emerged at the end

of July, however, Balfour Beatty

walked away from it about a

week later.

The sticking point seemed to be

Balfour Beatty’s previously stated

plan to divest its US engineering

subsidiary Parsons Brinckerhoff.

Two further offers were made

by Carillion, but Balfour Beatty

rebuffed both of these.

Both companies’ share prices

rose on the back of the news, but

now a deal looks unlikely.

Balfour Beatty’s board in

particular will have to work hard

to show it was right to turn down

an offer that would have paid a

premium to shareholders.

2 / 3

Built to Bobcat’s high equipment standards, Bobcat excavators are

designed to deliver strong performance in low weight machines

to put operators and owners in charge of labour-saving strength

and productivity. The Bobcat line of compact excavators is a perfect

example of our approach to design: never stop making it better.

E20

LATER THAT NIGHT…

BE PREPARED FOR ANYTHING!

awesome!

1\¼[ \QOP\ · J]\ _M¼TT OM\

\W \PM JW\\WU WN \PQ[

4]KSa PM¼[ WV W]Z [QLM

/WWL _WZS · VW_ \PM _PWTM KWUU]VQ\a

KIV JZMI\PM MI[a

<PQ[ RWJ KITT[ NWZ ]VXIZITTMTML TM^MT[

WN XW_MZ [XMML IVL IOQTQ\a

*]\ _IQ\

) TI[\ UQV]\M

KPIVOM WN XTIV