37

APRIL 2015

ACT

AUCTIONS

INDUSTRY FOCUS

oil andgas segment is goingdownand

housing is goingup, they’ll switchover. It

provides for goodauctionactivity.”

You can imaginewhich cranesdo

well at auction then. The all terrainsdo

exceptionallywell, asdo crawlers and

boom trucks.

“Crane availability is generallyadequate

todemand in every segment except all

terrain,” saidTobón. “Higherqualityall

terrain cranes aredifficult to findand

lower endproducts are coming into the

market ingreater volumes.”

This is somewhat of anew trend. The

oil andgas industry is flushwith cranes

that havebeen in the industry for fewer

than10years, but due toworkingdouble

or even triple shiftsduring theboom they

look like they’re20yearsold.

Rough terrain cranes (RTs) are a tough

sell right now, too, according toTobón.

“You cango into just about anyU.S.

dealer and they’ll haveplentyof inventory

of newRTs from2013 sitting in their

yards,”he said. “I knockon thosedoors a

lot toget them toauctionbut theydon’t

want topartwith them.”

It’s all abalancingact, as aremost

things in finance, and things appear tobe

stabilizing, but apprehension still persists.

“We’reon track topre-June2008 levels,”

saidTobón. “The supplyand thedemand

curves are there. Thevalue is there aswell,

but there’s just a lot of uncertaintyabout

2015. Peopledon’t take financing into

account asmuchas they should, like in

2008. Financing facilities arenot inplace

because lending institutions arebeingultra

conservative. That has a tendency toaffect

themarket in the auctionand retail sales.”

Endusers are responsible for about 70

percent of IronPlanet’s crane sales. Their

software-drivenmodel gives IronPlanet

the ability tomanage a spectrumof data

for sellers theyotherwisemight not

have. It’soneof themain reasonsCAT

AuctionServicesdecided tomergewith

IronPlanet.CATwas losing information

toauctioneerswhoweren’t interested in

a truepartnership.With IronPlanet, they

became amore informed seller,which

is attractive tobuyers. Just take a lookat

their first joint auctionand the$48million

W

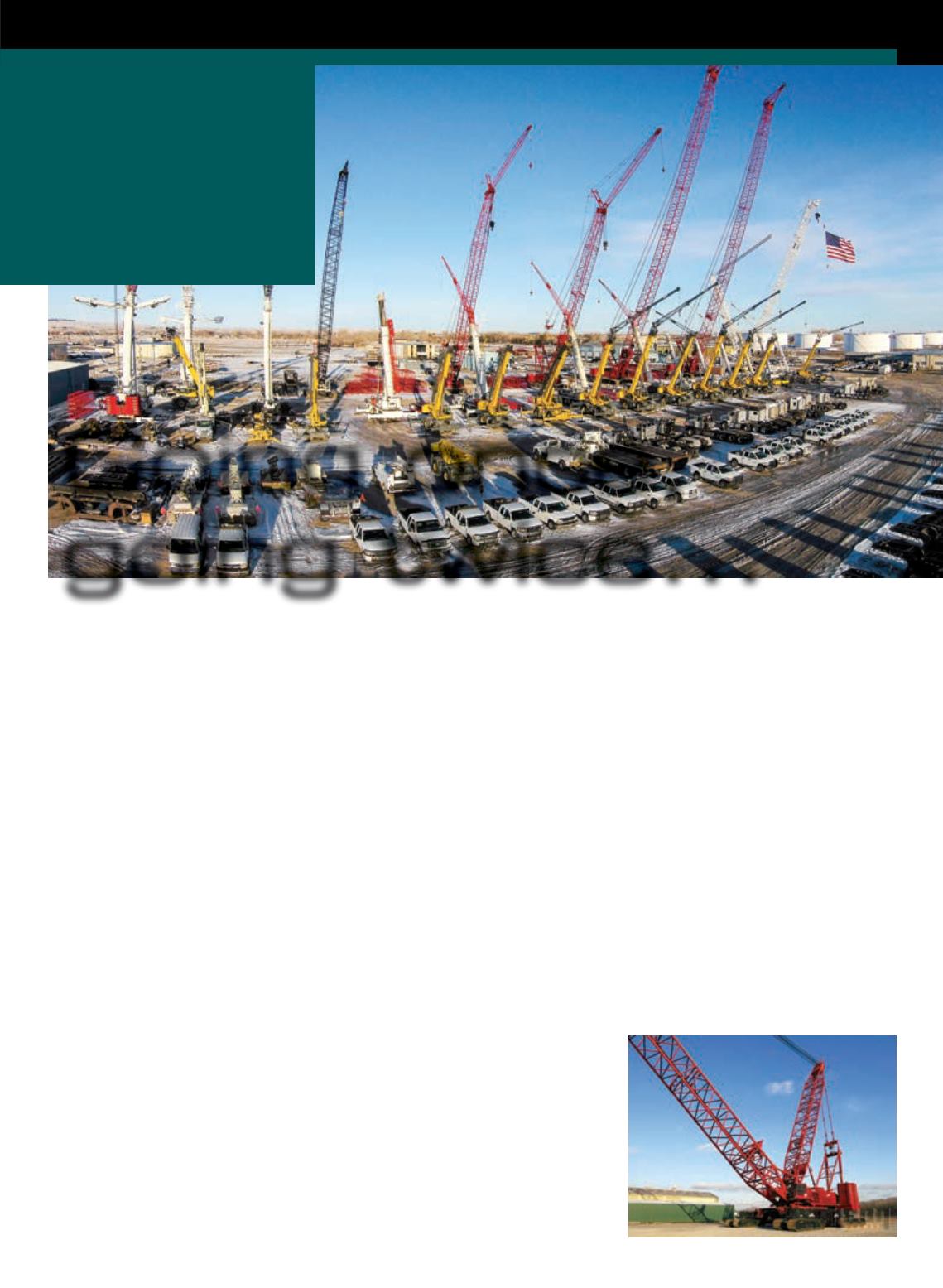

hen IronPlanetmerged

withCATAuctionServices

at the endof 2014, they

hadbig, bigplans for the futureof heavy

equipment auctions. Traditionallyan

onlinemarketplace, IronPlanet isnow

aiming tohost about 10 live, on-site

auctions ayearwith thehelpofCAT

AuctionServices. The first onewasheld

at the endof February, nettingover $48

million in sales.Onlyabout $1millionof

thatwas cranes, but there’smoreon the

horizon.

IronPlanet is targeting the segment of the

industry that loves the social aspect of a

live auction. Interactingwith competitors

and friends ina competitive environment

bringsout a level of excitement that online

auctions can’t alwaysproduce. That’snot

to sayonline auctions aren’t a thrill in their

own right.We’ve all been there, furiously

biddingon somethingonEBay,watching

the timer rundown, prayingwewin, but if

you’ve ever seena crane, and I’m sureyou

have, there’s just nothing like standing in

itsmassive shadow.

The cranemarket at IronPlanet’s auctions

is verydynamic, and that’sdue to the

versatilenatureof cranes as equipment,

according toDavidTobón, directorof

craneoperations for IronPlanet.

“Fortunately craneshave a tendency to

be able to switch fromone segment of

utilization toanother,” saidTobón. “If the

The used cranemarket

got a jolt after some

big auctions and a new

partnership.

John Skelly

reports.

Going once,

going twice...

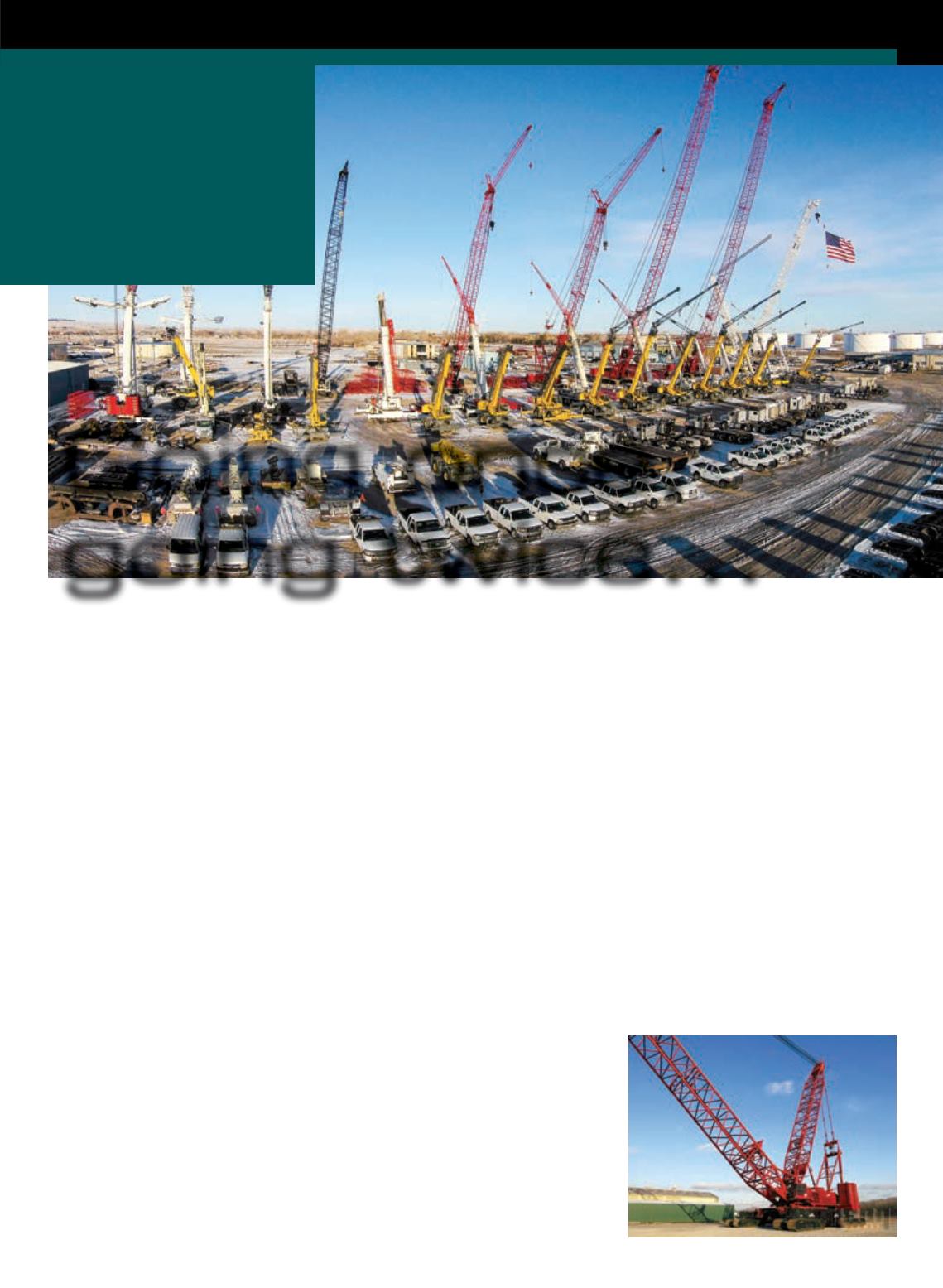

AManitowoc 21000 lattice-boom crawler

being sold on IronPlanet’s DailyMarketplace.