17

DECEMBER 2013

ACT

BUSINESS NEWS

AUTHOR:

CHRIS SLEIGHT

is one of

the world’s most internationally

renowned construction

business writers, with

specialist expertise in financial

markets and stock market

analysis. He is editor of KHL’s

market-leading

International

Construction

and is a regular

contributor to

ACT’

s sister

publication,

International

Cranes

and Specialized

Transport

.

November saw

share prices

continue the

impressive growth

of earlier this year

– particularly the

tech sector – but

heavy equipment

makers still lagged

behind.

Chris

Sleight

reports.

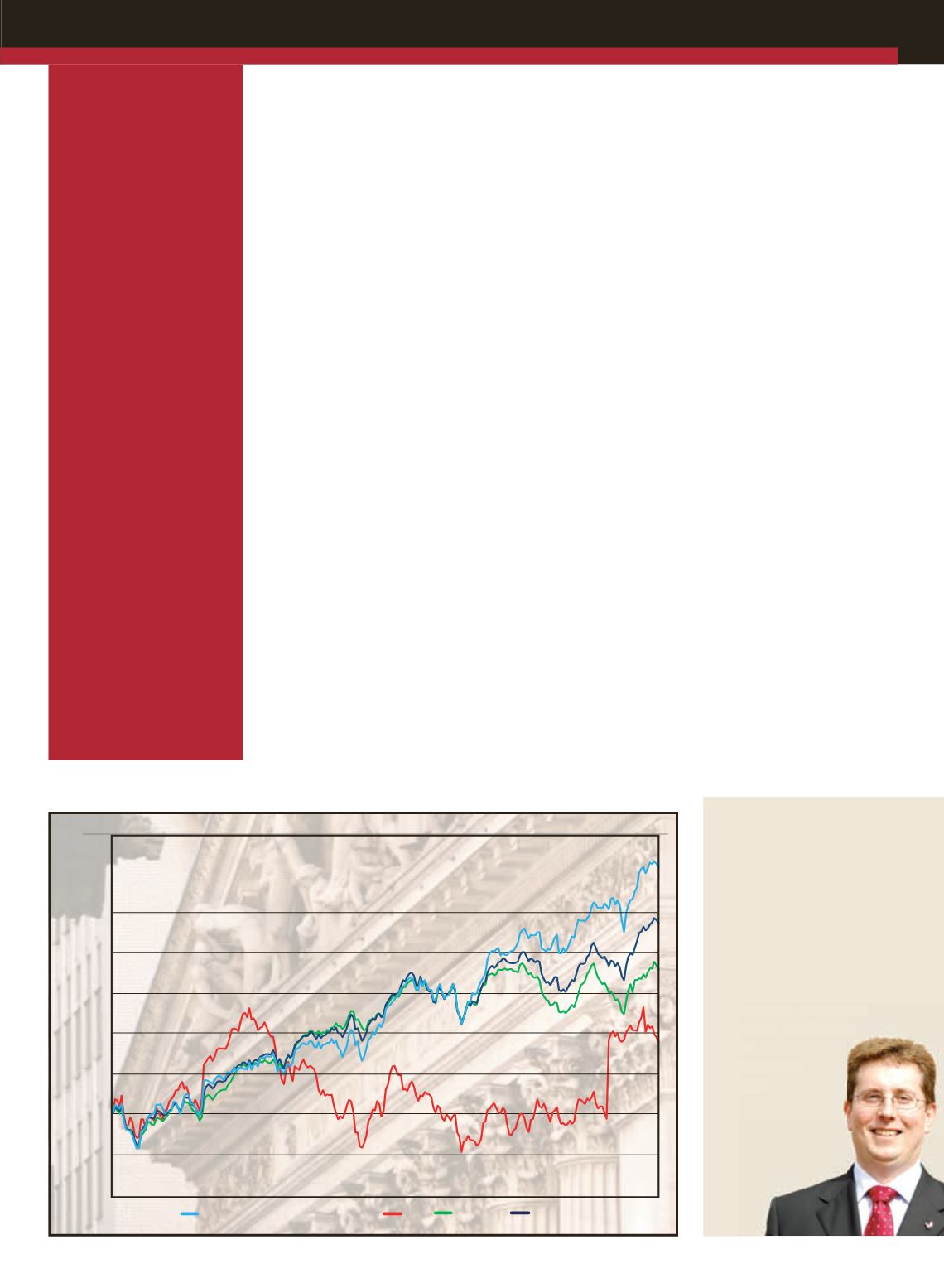

A

quick look at this

month’s graph

shows that share

prices continued to enjoy a

pretty much uninterrupted

growth trajectory in

November.

Give or take a few ups and

downs, this has been the

case for the broad market

indicators for the last 12

months. As a result, the

Dow is up nearly 20 percent

compared to a year ago, the

S&P 500 has gained some 25

percent and the tech-heavy

NASDAQ has moved ahead by

more than 30 percent.

Compare that to the

ACT

Heavy Equipment

Index (HEI) for lifting and

construction equipment

manufacturers. That has

gained only about 10 percent

compared to a year ago, and

most of that is due to the

sudden rise at the end of

September from the formation

of CNH Industrial. This

move saw construction and

agricultural equipment maker

CNH merged with a sister

company, Fiat Industrial,

which makes trucks, engines

and power train components.

CNH Industrial is worth

about twice as much as CNH

was, and this is why the

ACT

HEI shot up. If it were not for

this merger, the index would

likely be wallowing around

where it was just prior, with

little or no net gain compared

to a year ago.

Unfortunately, the

ACT

HEI probably paints a more

realistic picture of the world

economy at the moment.

GDP growth is sluggish,

and although there is clearly

a recovery underway, it is

gradual, and the return to full

health will be a slow journey.

One symptom of this is

relatively weak commodity

prices, which has hit

companies like Caterpillar,

which makes mining

equipment besides general

construction machines. It was

primarily the weakness in its

mining business that saw Cat’s

revenues fall some 19 percent

in the third quarter, compared

to a year ago.

But weak metals prices –

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P 500

35%

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

% change

52 weeks to November 2013

which of course includes

gold – has been a driver for

the Dow. With low interest

rates meaning there has not

been much to be gained form

investing in bonds, and the

classic ‘safe haven’ of gold in

retreat, investors have looked

to other instruments to

provide a limited return and

limited risk.

The answer this year has

been the Dow, which in

terms of equities is about

as safe as you can get. The

index is made up of 30 of

America’s largest corporations

– although Cat is one of them

– including the household

names of business, such

as Boeing, Microsoft and

Walmart. The benefit of being

large, stable corporations

that offer a dividend to

shareholders seems to have

become the new safe haven in

2013.

As the economic recovery

continues, shares in the

ACT

HEI will find momentum

of their own, but there is

not much sign of that at

the moment.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’s most

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Broad growth