BUSINESSHIGHLIGHTS

IRELAND

CRH to buy Lafarge and

Holcim assets

SingleUS$7.3billiondeal seesHolcim and Lafarge

shedbusinesses togain approval formerger

C

RHhas agreed tobuybusinessesworth€6.5billion (US$7.3billion)

fromLafarge andHolcim, which the two companies have todivest to

gain regulatory approval for their plannedmerger.

Most of the businesses being acquired are based in either Europe orNorth

America, but it will also gain cement and aggregates facilities in emerging

markets including Brazil and the Philippines. However, as CRH already has

a significant presence inEurope andNorthAmerica it remains to be seen if

it will have to divest some existing or acquired businesses to gain regulatory

approval for the deal.

CRH said the acquisitionwouldbe fundedby€2billion (US$2.6billion)

in cash from its balance sheet, newdebt and theproceeds of an equityplacing

of 9.99% of CRH’s current issued share capital. Completion of the deal is

expected in the first half of this year.

The company said it had identified € 90 million (US$ 102 million) of

savingswhichwouldbe achieved in the first three years after the acquisition.

US

Flat 2014

Caterpillar’s revenues for 2014

were US$ 55.2 billion, a -1% fall

on 2013. However, the company’s

profitper share in2014 improvedby

+2% over 2013 levels toUS$ 5.99.

Thiswasdespiteadip inprofitability

in the fourthquarter.

The company is forecasting a

-10% decline in revenues in 2015,

based on the expectation of only

modest global economic growth and

continued weakness in commodity

prices.

AUSTRALIA

Divestment bonus

LeightonHoldings had revenues of

AU$18.4billion (US$14.3billion)

last year, a+4% increaseon2013. Its

net profit after tax was up +33% to

AU$ 677million (US$ 525) thanks

in part to the disposal of its 50%

of its Services business and John

Holland.

The companybooked anet gainof

AU$424million (US$329million)

on the sale of John Holland to

CCCCI in December. Meanwhile

the rolling of 50% of its Services

businesses into a joint venture

with Apollo Global Management

brought a pre-tax net gain of

AU$550million (US$426million).

However, these gains were eroded

by a AU$ 675 million (US$ 524

million) charge which the company

describes as a “Contract debtors

provision.” It said this was to cover

the risk of unrecoverable payments

due to it on various contracts.

SWITZERLAND

Exchange impact

Holcim’s sales fell -3.1% to CHF

19.1 billion (US$ 20.1 billion) in

2014. Its operating profit was down

-1.7% to CHF 2.32 billion (US$

2.45 billion) for 2014, although it

increased its overall sales of cement

last year to140million tonnes, from

139million tonnes in2013.

The company said unfavourable

exchange rates and costs linked to

consolidating its operations affected

its financial performance. However,

it said that on a like-for-like basis

saleswere up+3%.

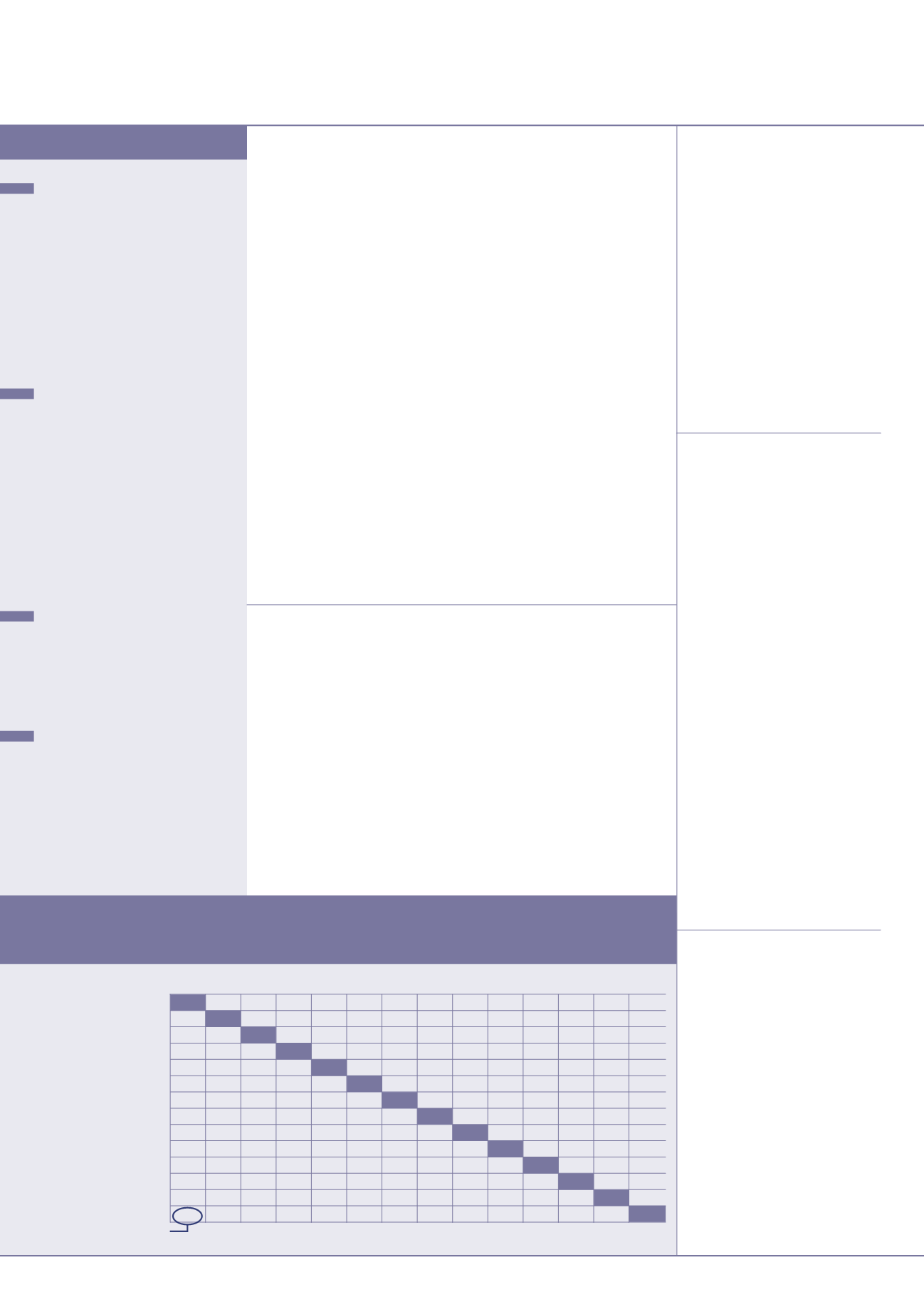

VALUEOF 1:

SYMBOL AU$

BRL

UK£ CNY

€

INR

YEN MXN RUR SAR

ZAR KRW CHF

US$

AustralianDollar

AU$

0.44 0.507 4.90 0.695 48.3

93

11.72 47.8

2.93

9.06

859 0.741 0.781

BrazilianReal

BRL

2.27

0.223 2.15 0.306 21.2

41.0

5.15

21.0

1.29

3.99

378 0.326 0.344

BritishPound

UK£

1.97

4.48

9.7

1.37

95.2

184

23.1

94.3

5.78

17.9

1695 1.46

1.54

Chinese Yuan

CNY

0.204 0.464 0.104

0.142 9.86

19.0

2.39

9.76 0.598 1.850

175 0.151 0.159

Euro

€

1.44

3.27

0.73

7.04

69.4

134

16.9

68.8

4.21 13.03 1236 1.07

1.12

IndianRupee

INR

0.021 0.047 0.011 0.101 0.014

1.9

0.243 0.990 0.0607 0.188 17.8 0.0154 0.0162

Japanese Yen

YEN

0.011 0.024 0.005 0.053 0.007 0.518

0.1256 0.513 0.0314 0.0972 9.2 0.0079 0.0084

MexicanPeso

MXN

0.085 0.194 0.043 0.418 0.059 4.12

7.96

4.08 0.250 0.773

73

0.063 0.0667

RussianRuble

RUR

0.021 0.048 0.011 0.102 0.015 1.01

1.95 0.245

0.061 0.190 18.0 0.0155 0.0163

Saudi Riyal

SAR

0.341 0.776 0.173 1.672 0.237 16.480 31.840 4.000 16.320

3.09

293 0.253 0.267

SouthAfricanRand ZAR

0.110 0.251 0.056 0.541 0.077 5.328 10.293 1.293 5.276 0.323

95

0.082 0.086

SouthKoreanWon KRW

0.0012 0.0026 0.0006 0.0057 0.0008 0.0562 0.1085 0.0136 0.0556 0.0034 0.0105

0.00086 0.0009

Swiss Franc

CHF

1.35

3.07

0.68

6.61

0.94 65.12 125.82 15.81 64.49 3.95 12.22 1159

1.054

USDollar

US$

1.28

2.91 0.649 6.27

0.89

61.8 119.4

15

61.2

3.75

11.6

1100 0.949

For exampleUS$ 1=AU$ 1.28

Exchange rates: February 2015

UAE

Al FuttaimCarillion (AFC) has

been named preferred bidder on two

contracts inDubai worth a total of

UK£ 380million (US$570million). It is

in line for aUK£ 225million (US$344

million) contract to build amixed-use

development on theDubai Creek

waterfront and theUK£155million

(US$ 237million) contract for the

construction of the ‘LaMer’ beachfront

development at Jumeirah.

CHINA

Deutz and Volvo have said

theywill not go aheadwith a previously

announced engine joint venture in

China. The two companies said in

April 2012 that theywould set up a

majorityDeutz-owned factory tomake

medium duty engines for off-highway

applications inChina. However, the

weak local market has prompted the

reversal of that decision. They added

that no significant investments had

beenmade in the venture to date.

SWEDEN

Atlas Copco has decided

to end production of its Powercrusher

compact crushing and screening

equipment range. Atlas Copco acquired

the business, previouslymarketed

under theHartl brand, in 2010.

AUSTRALIA

A joint venture between

Bouygues and Lend Lease haswon the

€

1.9 billion (US$2.1 billion) tunnelling

contract on theNorthConnex road

project inSydney. The project for the

design and build of the 9 km twin-tube

tunnel, is part of a scheme linking the

south of theM1PacificHighway at

Wahroonga to theM2HillsMotorway.

international

construction

march 2015

BUSINESSNEWS

10

INDIA

UltratechbuysmoreJaypeeplants

Jaiprakash

Associates

(Jaypee

Group) is to sell two cement plants

in India’s Madhya Pradesh state

to fellow cement manufacturer

Ultratech. The assets comprise

cement plants and grinding facilities

with a total capacity of 4.9 million

tonnes per year along with an 180

MW power plant to supply them.

The net transaction value is INR

3,750 crore (US$628million).

Ultratech said the acquisition

wouldtakeitscementmanufacturing

capacity in India to some 65million

tonnes.

The sale is part of Jaypee’s

programme to pay-down debt,

which has included some INR

10,000 crore (US$ 1.6 billion) of

divestments in its cement business. .

Is largest previous cement

divestment was also to Ultratech

for a 2.4 million tonnes per yeear

facilitiy inGujarat.