21

november 2014

international

construction

REGIONALREPORT

Major challenges lie ahead

>

economic picture. In his opinion, the knock-on effect would be

growth of between +3% and +5% next year in the equipment

rental market.

He said, “There is a reduction in demand for new equipment,

both Russian and equipment produced overseas, though

demand in the rental sector remains stable.

“As a result of difficultieswithnew equipment sales, dealers are

ready tooffer special purchase conditions for rental companies –

which is a good investment driver for the rental industry.”

One high-profile equipment supplier inRussia is JCB, whose

dealer Stroykomplekt opened a US$ 9.7 million facility at

Ekaterinburg last year.However, JCB said therehas been a sharp

market decline this year. Consequently, it has just announced

150 redundancies at its UK offices owing to a “severe decline”

inworldmarkets.

A JCB spokesperson said, “Russia is a very important market

for JCB and has been for more than 30 years. The Russia-

Ukraine crisis has had a particularly significant impact on JCB

with sales to both countries dramatically down over the past

three months. For the six months to June 2014, Russia was

down by -22%.

“Despite the current difficult market conditions JCB Russia

has significantly invested in the promotion of JCB’s machines

and service back up by attending leading exhibitions inRussia.

“Large numbers of JCB machines, including backhoes,

T

here are not many people who are up-beat about the

Russianmarket at themoment. As Scott Hazeltonwrites

in thismonth’sEconomicOutlook, growth is at bestweak

in the constructionmarket.

But that is not to say that there aren’t good projects coming

through.There is investment in infrastructure, oil&gas projects

andof coursedevelopment around venues and infrastructure for

the 2018WorldCup, but there are still issues.

Construction equipment rental companies such as theCramo

Group have reported challenging conditions, which it believes

have been influenced by the ongoing tensions between Russia

andUkraine.

Nikita Krotkiy, of the RusRental organisation, said that

construction sector conditions had indeed been turbulent

over past fewmonths following trade sanctions being imposed

– which have targeted Russia’s banking, energy and defence

sectors.

However, the rental sector expert said factors such as the

World Cup and other infrastructure deals would improve the

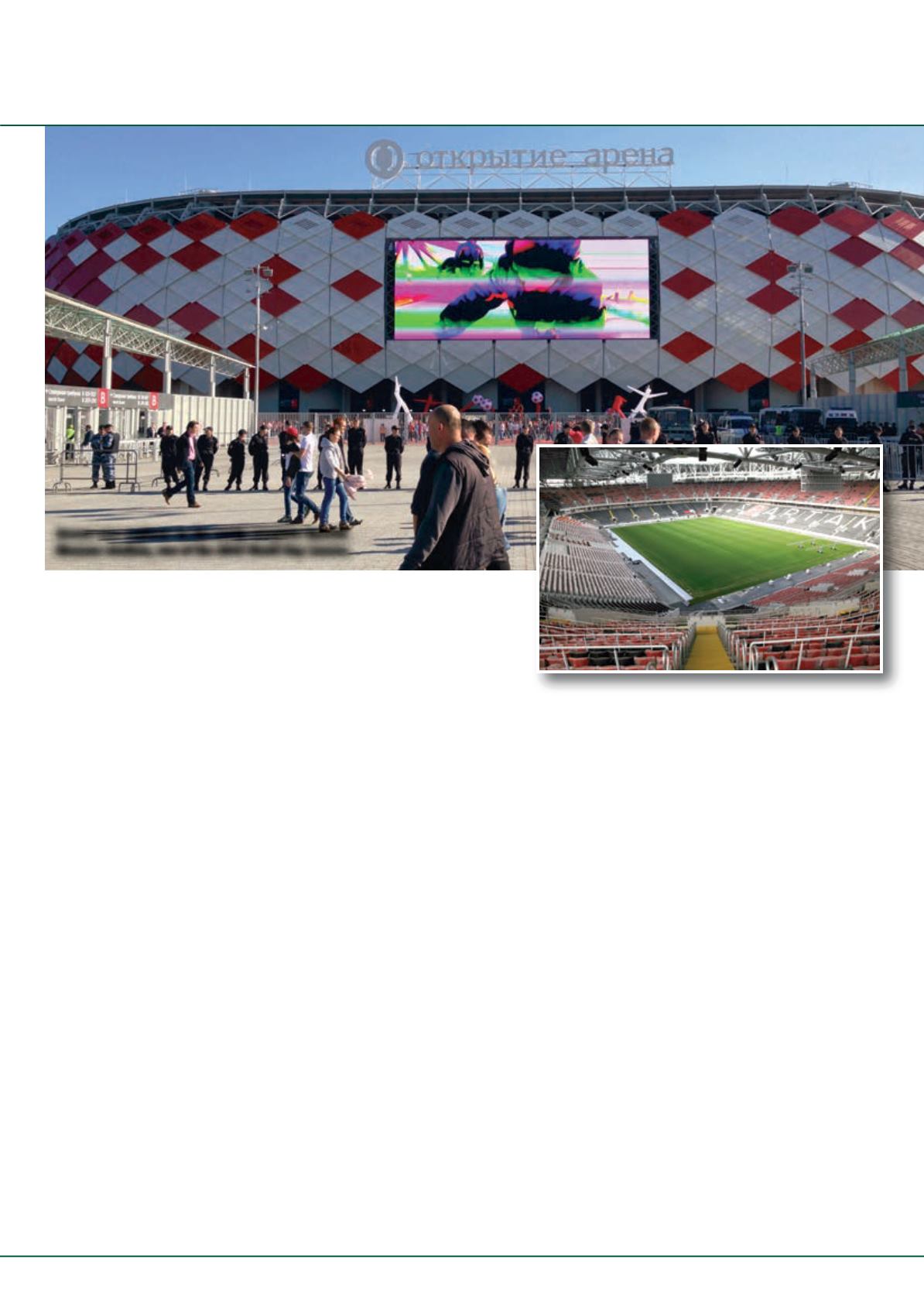

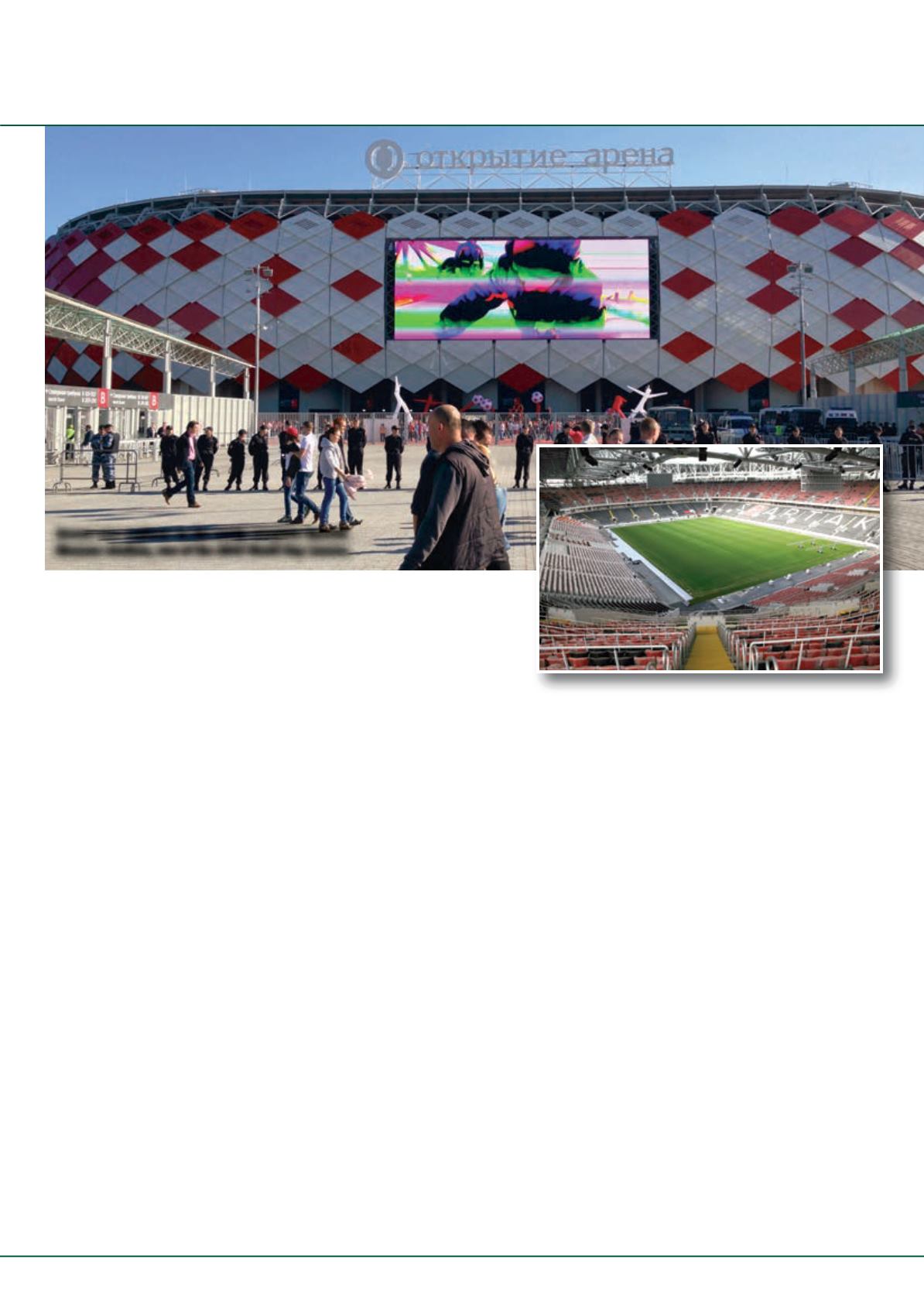

Aecomwas engineer on the newly complete Spartak

Mascow stadium, one of the 2018World Cup venues.

Major challenges

lie ahead

Despite global sanctions, the 2018WorldCup and key

construction projects inMoscow in particularmay offer

hope for construction inRussia.

Neill Barston

reports.