17

ECONOMICOUTLOOK

Failingmarket

november 2014

international

construction

>

Failingmarket

The Russian constructionmarket was lookingweak even before its actions in the Ukraine triggered a

flight of capital and economic sanctions.

Scott Hazelton

reports.

T

he Russian economy was heading for

disappointing economic growth even

before relations with theWest deteriorated

over the Ukraine. It is now faltering amid

declining net exports, slack investment activity,

targeted economic sanctions, and the threat of

further andbroader sanctions.

Russia is overly dependent on energy exports

(70.6% of export earnings in 2013) to drive

domestic growth. Energy prices are expected

to remain relatively weak but stable at current

levels in the near-to-medium term as geopolitical

tensions in producing regions are offset by the

impact of moderate global demand, even as

alternative supplies of energy are rapidly coming

on stream. In addition,Russian interest rates have

been raised to help stem the flow of capital from

the country and relieve some of the downward

pressure on theRuble.

However, GDP growth in the first quarter of

2014 was just +0.9%, and the flash estimate put

GDP second quarter growth at +0.8%, implying

stagnation.

Stubbornlyhigh inflation,partlydue toaweaker

Ruble, is cutting household purchasing power.

And with the Ruble and equity prices losing

ground in2014, the threat of further andbroader

economic sanctions due toRussia’s annexation of

the Crimea, and perceived Russian intervention

in Ukrainian affairs is only worsening the

environment.

The erosion of business confidence has caused

investment activity to contract. Estimates are

that net capital outflow in the first half of 2014

hit US$ 74.4 billion, compared with US$ 62.7

billion for all of 2013. IHS Global Insight has

cut itsGDP growth forecast in2014 from+0.5%

to a decline of -0.5%. We have further reduced

growth in 2015 to +0.9% from +1.7%, and in

2016 to+1.5% from+2.5%.

In response, President Putin has decided to

tap the National Wealth Fund—intended to

address shortfalls in the Russian pension system

expected to worsen because of unfavourable

demographics—to fund infrastructure projects

and jump-start economic growth.

Through the medium term, Russian economic

growthwill continue todepend ondevelopments

in world-market prices for fuels and other basic

commodities. Further brakes on robust growth

include the underdeveloped domestic banking

sector and heightened investor aversion to risk in

Russia.

Should the tensions withWestern powers over

Ukraine escalate, recession could extend beyond

2014. In themedium term, however, growth can

return to around +3.0%, settling below that after

2020.

Providing investment capital for the medium

and long terms will be critical for propping up

economicgrowth,yetthe investmentenvironment

has become increasingly unattractive.

Someof themost important industrial branches

in bothmanufacturing and the natural-resource-

extraction sector are facing effective capacity

constraints because of an extended period of

insufficient investment.

In natural-resource extraction in particular,

which comprises 25% of the entire Russian

economy, real growth has slowed markedly and

exploitation is increasingly capital intensive, yet

the Russian environment for investment will

remain relatively unattractive, and the perception

of risk inRussiawill remain acute.

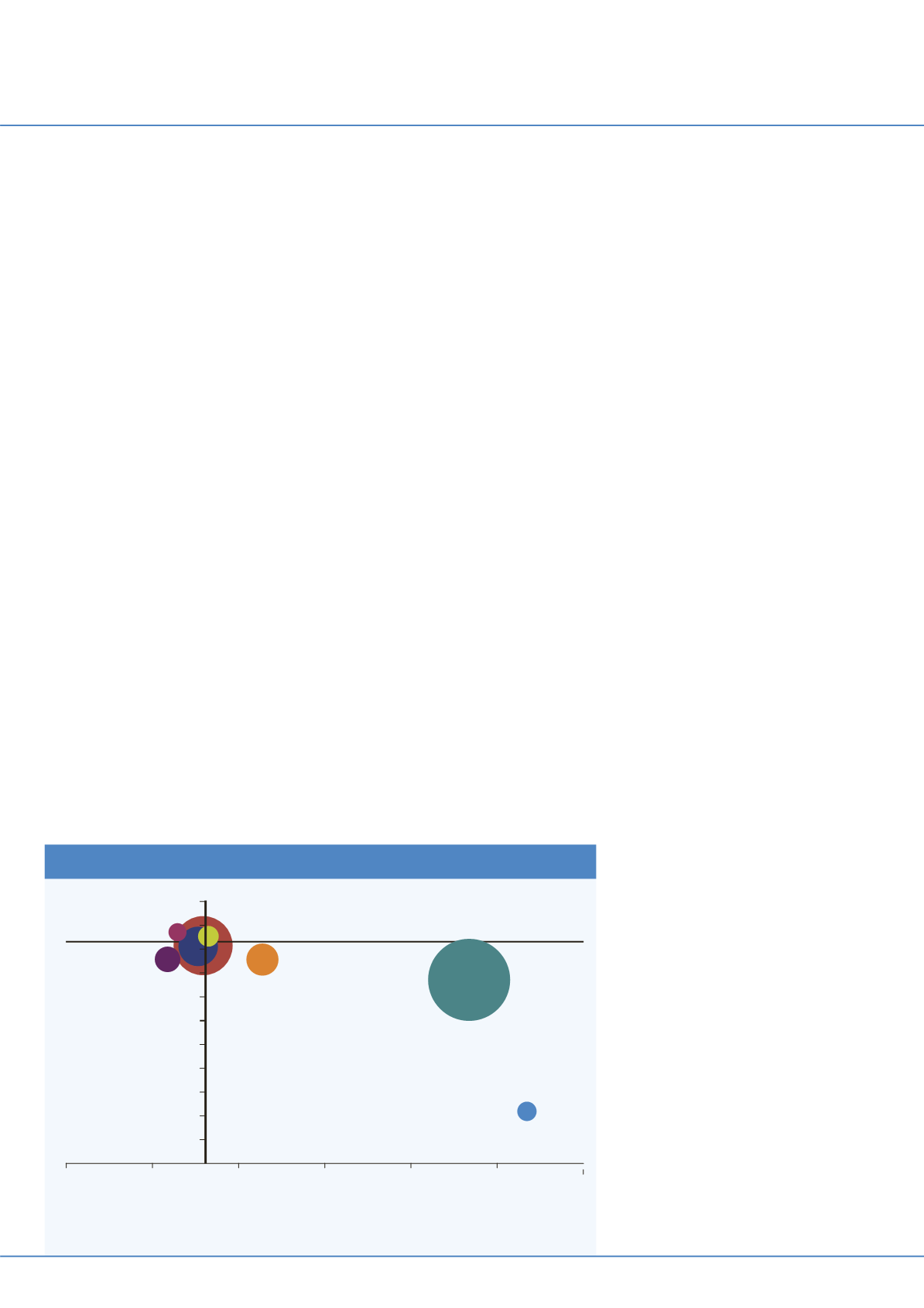

Construction risk

Indeed, international tension, finances and a

lack of transparency in business practices create

a relatively high risk for construction companies

in Russia. The first chart shows the risk

associated with a long-term investment project

inRussia comparedwith other EasternEuropean

economies.

The construction risk score is an indication of

long-term investment risk, including such factors

as ability to repatriate earnings, enforce contracts,

protect intellectual andphysical property and the

stability of the workforce and prices.The “cross-

hairs” indicateglobal average riskandgrowth.The

size of the circle indicates the size of themarket.

Russia quite clearly offers significantly higher

risk with below-average growth prospects, not

just globally but also for the Eastern European

region. Only beleaguered Ukraine offers worse

prospects for construction companies.

Real incomes had benefitted from strong

growth in nominal wages due to a relatively tight

labour market. Residential spending increased

+7% in 2013 and the momentum into 2014

suggests growthnear+8%.However, inflationhas

heated up and consumer confidence has eroded.

Residential construction will retreat significantly

in2015 and average just +2.6%over the next five

years.

Spending on non-residential structures

contracted -4.2% in real terms in 2013, with

institutional construction faring the best, while

commercial construction had the weakest

performance.

IHS Global Insight anticipates non-residential

construction spending will decline a further

Construction growth, risk andmarket size

10

15

-5

-4

-3

0

1

5

20

25

30

Global Median

35

40

CONSTRUCTION SPENDINGGROWTH 2013 - 2018

FIVE-YEARCONSTRUCTIONRISK SCORE

●

Hungary

●

Ukraine

●

Czech Republic

●

Russia

●

Bulgaria

●

Slovakia

●

Romania

●

Poland

-2

-1