ECONOMICOUTLOOK

18

Failingmarket

international

construction

november 2014

-7% in 2014 with virtually no growth in 2015.

Growth should return in 2016, but only at +4%,

and average growth over the next five years will

be just +3%

Government spending on public sector

investment is beingused tobolster the popularity

of the Putin regime. Even so, infrastructure

spending fell -4.4% in real terms in 2013 and

another -3%decline is expected in2014.

the medium term calls for some economic

improvement, and evenwith its problems, Russia

should be able to find the capital to support

+3.0% average growth over the next five years,

leadby infrastructure.

It should be noted that this is 1.3 percentage

points weaker than IHSGlobal Insight’s forecast

a year ago, indicating thatRussia is paying a price

for its domestic and foreignpolicymiscues.

iC

IHSGlobal Insight

Recognised as themost consistently accurate

forecasting company in theworld, IHS Global

Insight has over 3,800 clients in industry, finance,

and government with revenues in excess of

US$ 80million, 5,100 employees and 50 offices

around theworld in 30 countries. 80% of Fortune

500 companies are customers of IHS Global Insight.

■

For more information onmatters discussed in

this article or Global Insights’ services, visit

or contact Scott Hazelton

in the US on+1 781 301 9044 or at

Spending on energy infrastructure fared the

best, while spending on water/sewer was the

laggard.

Infrastructure spending is forecast to return to

growth in 2015, although only at +1%. Better

growth around+5% for2016 and2017will allow

the five-year average tohit +3.3%

Taken together, Russian construction spending

will decline once more in 2014. However,

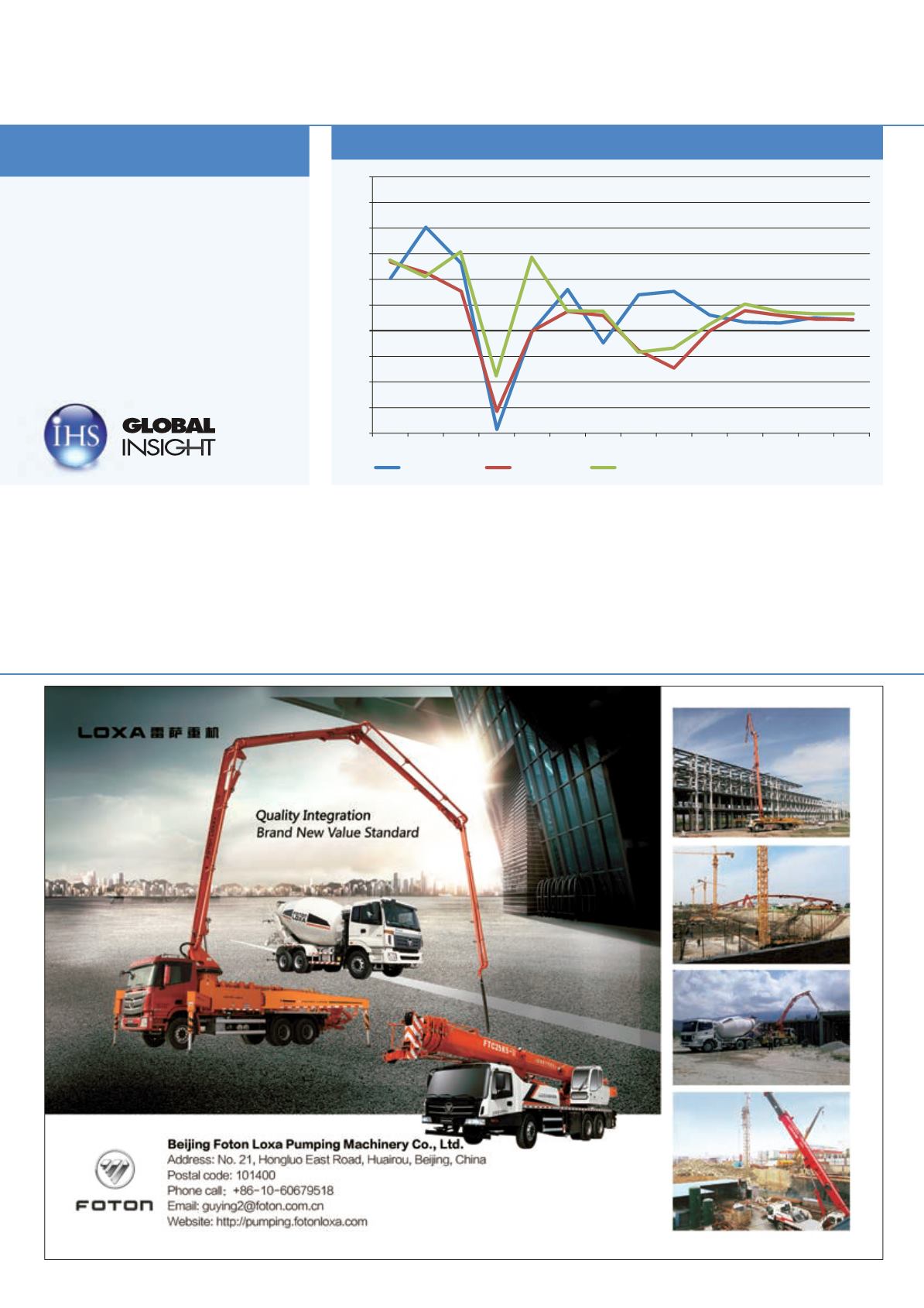

Russian construction growth by sector

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

-15%

-20%

2006

Residential

Structures

Infrastructure

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

2019

2018