21

MAY 2014

ACT

BUSINESSNEWS

AUTHOR:

CHRISSLEIGHT

is

one of theworld’smost

internationally renowned

construction businesswriters,

with specialist expertise in

financial markets and stock

market analysis. He is editor

of KHL’smarket-leading

International Construction

and

is a regular contributor to

ACT’

s sister publication,

International Cranes

and Specialized

Transport

.

In a reversal of

fortunes over

the previous 18

months, March

and April saw the

heavy equipment

sector rally as the

widermarkets

faltered.

Chris

Sleight

reports.

M

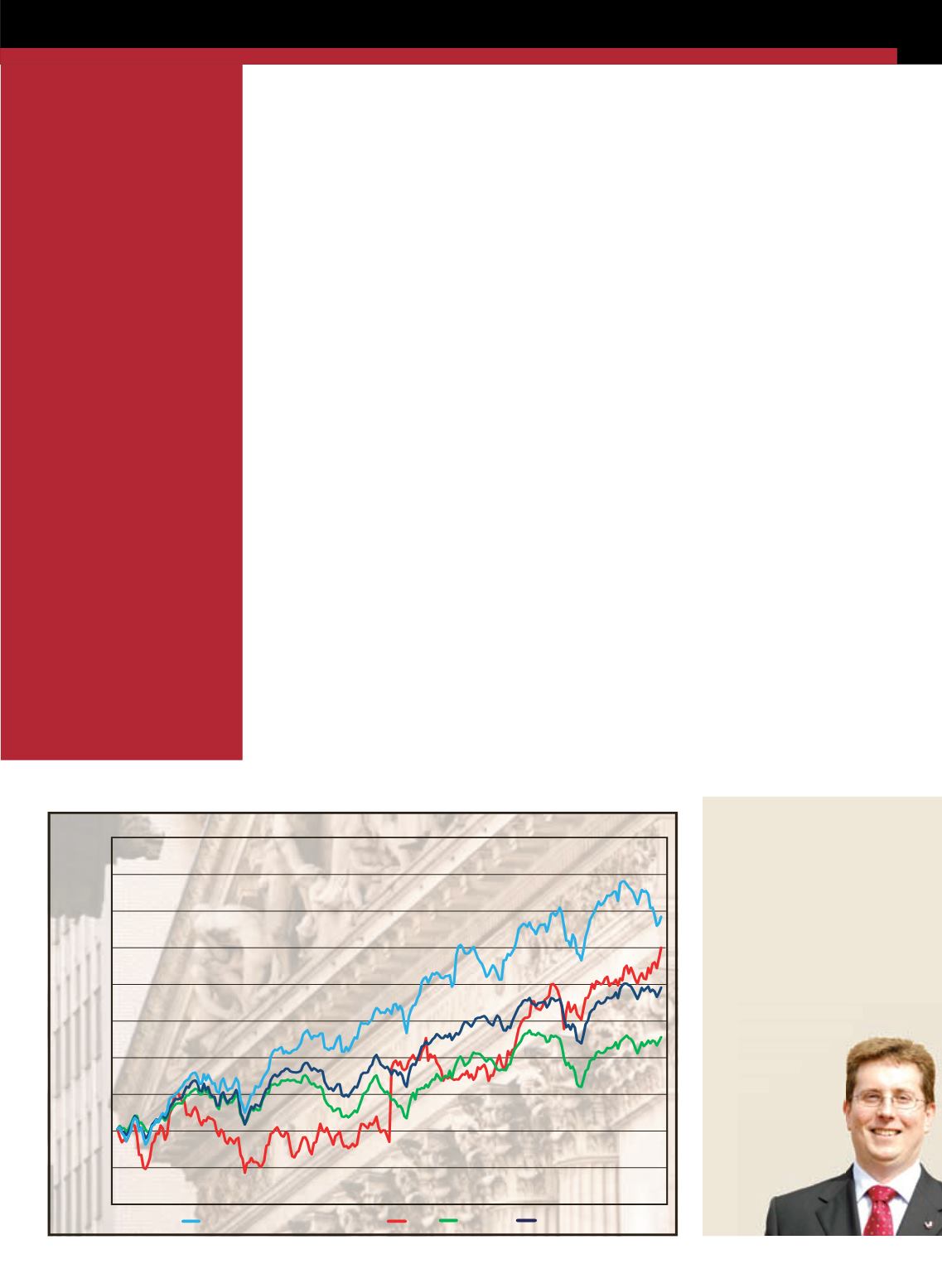

arch andApril

saw shares

in theheavy

equipment sector continue

to rally, even aswider stock

market indicators levelled-

off or fell. Thiswasmuch

against the runover the last 18

months or so,whichhas seen

equipmentmanufacturers lag

behindblue-chipbenchmarks.

like theDow.

Theprevious dynamicwas

thatmainstream stockswere

bought by investors as a safe

haven. This saw theDow and

manyother indicators hit

unprecedented levels, despite

the lackluster economic

picture.

However, since the start

of the year, yields onmore

traditional safehavens have

started to rise,while the

improving economicpicture

has increased investors’

appetite for greater risk and

reward. The sell-off has

not beenhuge yet, but the

levelling-off andbeginnings of

adecline inboth theDow and

S&P500 toward the endof

March could signal the start of

a shift in investment patterns.

Add to this thepolitical

tension inEuropeoverRussia’s

annexationof theCrimea,

in theUkraine, and it isnot

surprising that indicators are

experiencingwobbles.

Economic drivers

In contrast, capital goods

sectors like the the

ACT

HeavyEquipment Index

(

ACT

HEI) have gone from

strength to strength. This

seems tohavebeendriven

bymore fundamental

economic reasons than the

more technical drivers behind

themainstream indicators’

downturn.

Heavy equipment stocks

arebehavingmore rationally,

with shareprices rising in

the expectationof improving

revenues andprofits over

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P500

40%

35%

30%

25%

20%

15%

10%

5%

0%

5%

-10%

% change

52weeks to April 2014

thenext fewquarters, thanks

to an improvingdomestic

and international economic

picture.

Of course this could all

change. So far the situation in

theUkrainehas onlyprovoked

adiplomatic andpolitical

response againstRussia from

the rest of theworld. Serious

economic sanctionsmay

follow,whichwould likely

trigger a response fromRussia

– at the timeofwriting itwas

making threats to suspendgas

supplies toWesternEurope.

The situation couldget

worse,with a genuine global

economic impact, but fornow

it is reasonably contained.

Meanwhile, theheavy

equipment sector is looking in

muchbetter shape thanonly

a fewmonths ago. It hit its

highest point in three years in

April at 212points and could

goon tobreak its all-time

record around the 220point

mark if the rally continues.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’smost

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Equipment

sector rallies