EQUIPMENT

66

international

construction

july-august 2014

LIUGONG

years of so we have seen some of

the new players in the industry

disappear.

“That’s generally good for the

industry, as China has too many

players.

“But both the Chinese

manufacturers and the overseas

players in China face the same

problem. They all have too much

capacity, so there is no incentive to

consolidate. The other problem is

that these small players don’t really

have any value to add, so there is

no incentive to buy them. We have

seen factories close and new players

move into other industries,” he

said.

New approach

Such big changes in the competitive

and market landscape seem to have

prompted a change in emphasis

for Liugong, particularly when

it comes to establishing a more

international footprint.

“We are not slowing down, but

we are doing these projects more

carefully. I think in the past we

and other Chinese companies

jumped in too fast. We are not

slowing down, but we are spending

more time on strategic plans and

watching the markets carefully,”

said Mr Zeng of the company’s

internationalisation strategy.

He added, “At this moment we

need to find a more reasonable

way to be a global company. The

Chinese market has dropped a lot

and we need to think about how to

balance the domestic market and

overseas markets. Overseas markets

are more important than before.

But at the same time, there are

fewer competitors now in China.”

Liugong has certainly been

one of the frontrunners in the

globalisation of the Chinese

construction equipment

industry. In 2009 it opened the

first overseas factory built by a

Chinese construction equipment

manufacturer, near Indore, in

India. This was followed in 2012

with the company’s first overseas

acquisition, the purchase of Polish

dozer manufacturer, HSW.

Joint ventures

More recently, Liugong has signed

a series of joint venture agreements

in China that are more focussed

on its domestic market. Liugong

Group has established a partnership

with Metso to build and market

mobile crushers in China –

effectively a new product type for

the market.

“The market at the moment is

zero. We are creating the market,”

said Mr Zeng. “So far, so good.

We have built the first prototype

and sold it. We have also utilised

the Liugong sales force to sell the

products.”

More in the mainstream are

Liugong’s new joint venture

with ZF to make transmission

components and a partnership with

Cummins to build engines.

The relationship with ZF goes

back to 1995, when an agreement

was signed that saw Liugong

supplied with German-designed

axles. However, the more recent

development, a further JV signed

in September 2012, will see

components marketed to other

Chinese OEMs as well as being

produced for Liugong.

Another subtle, but important

twist is that the axles are jointly

designed by Liugong and ZF. It

is not just a case of a Chinese

manufacturer gaining access to

western technology, but there

is also the element of Liugong

helping the world-famous German

company produce components

tailored to the local market.

There are similar elements in

the joint venture with Cummins,

which was signed in October

2011 and started manufacturing

in March last year. There are two

engines being produced, a version

of Cummins’ 7 litre QSB7, which

is available in power ratings of

120 kW, 134 kW or 160 kW for

20 to 30 tonne excavators, and the

9.3 litre L9.3 for 5 tonne capacity

(about 3 m

3

bucket capacity)

wheeled loaders.

Although this latter 162 kW unit

is fairly simple, with its mechanical

fuel pump and Tier 2 emissions

compliance, it is a unique engine

designed specifically for this

application – you will not find a

9.3 litre engine elsewhere in the

Cummins range.

Again the deal is that the joint

venture, Guangxi Cummins

Industrial Power Company

(GCIC), produces engines for use

by Liugong as well as for sale to

other OEMs through Cummins’

Chinese sales infrastructure.

According to GCIC deputy

general manager Hengliang Pan,

the specially tailored version of the

QDB7 being produced is “Very

competitive on fuel consumption,”

with about a 15% saving on other

engines available on the market. He

added that noise levels were 50%

lower.

The factory passed its milestone

of producing its 10,000th engine

in June, and Mr Pan said he was

confident of eventually achieving

the target of 50,000 engines per

year, although he said it would be a

challenge in the current market.

And according to Mr Zeng, both

joint ventures are paying dividends,

despite them coming on stream at a

time when the industry is in a lull.

“They have both been good

for us. They have provided a

competitive advantage, high quality

levels, ‘famous’ components and

good delivery times,” he said.

iC

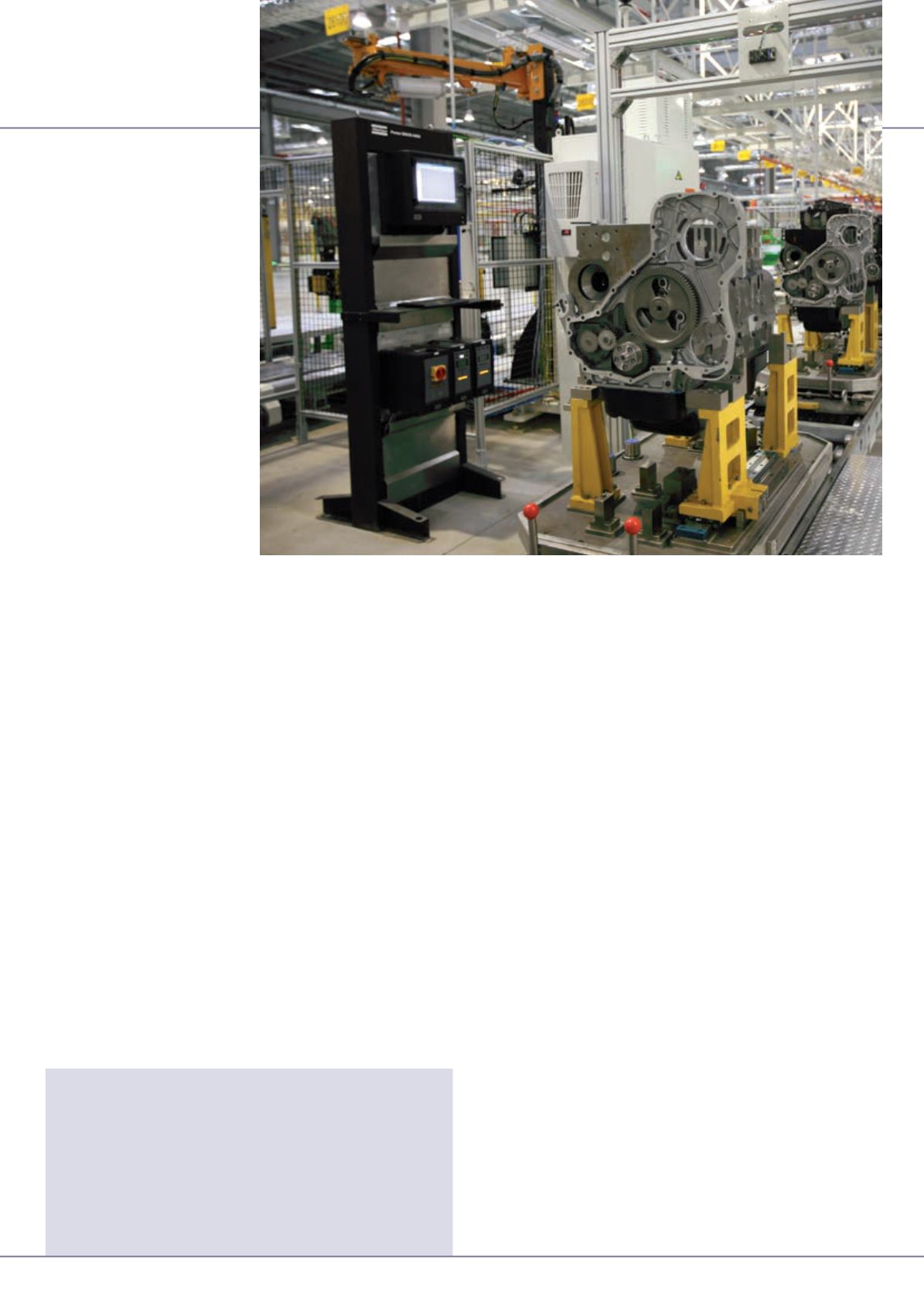

The new Cummins-Liugong

joint venture engine plant in

Liuzhou, China.

“I think in the past we and other Chinese

companies jumped in too fast. We are not

slowing down, but we are spending more time

on strategic plans and watching the markets

carefully.”