17

december 2014

international

construction

REGIONALREPORT

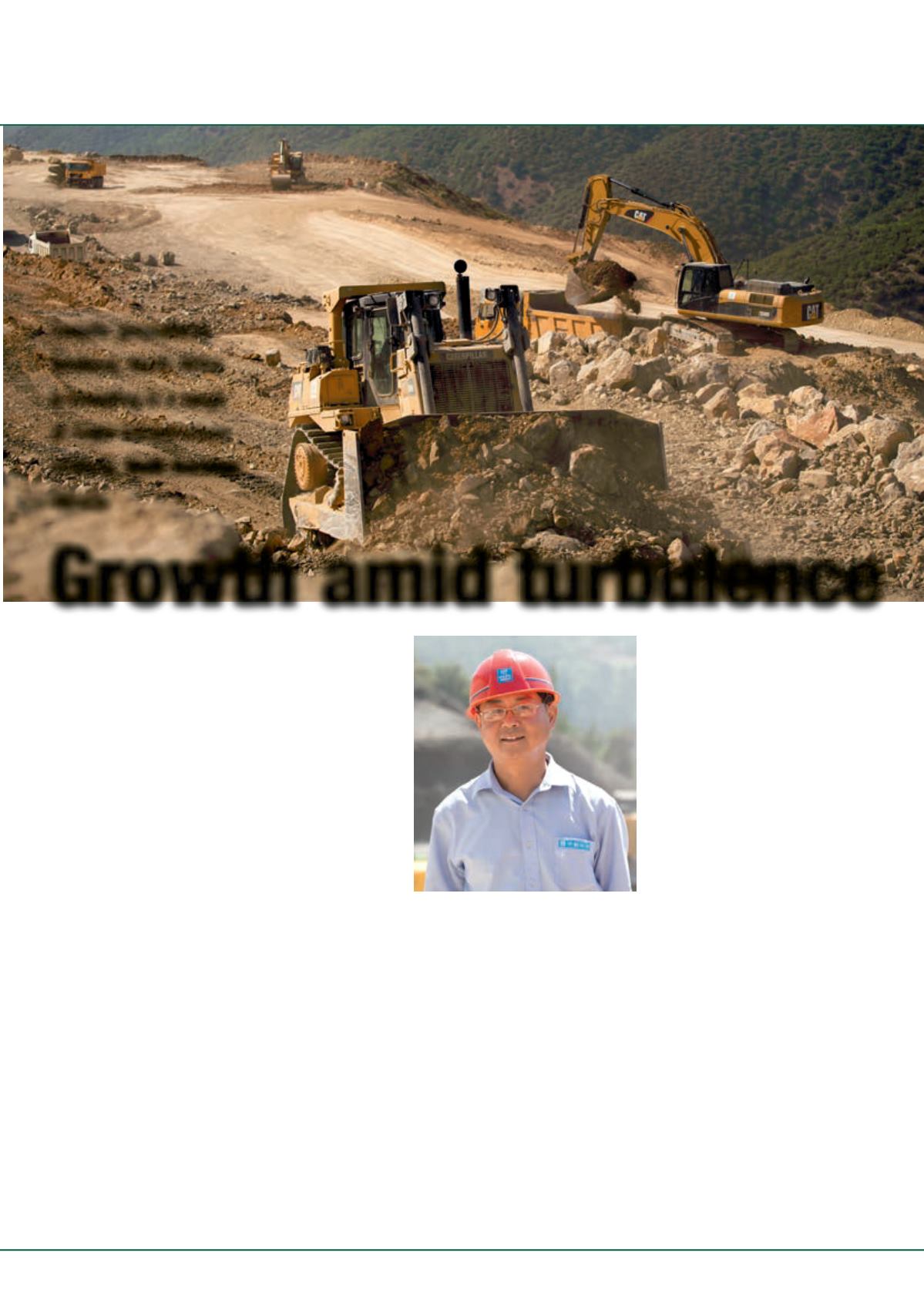

Growth amid turbulence

>

billion between 2010-14 to deliver new

road networks and other major civil

engineering projects.

This has included ongoing work on

a 3,000 km Trans Sahara Highway,

which has seen a number of companies

including Caterpillar play a role in

deliveringa53km sectionbetweenChiffa

andBerrouaghiawithinAlgeria.

The project, which began last year, is

due for completion in 2017 and has seen

China State Construction Engineering

Corporation (CSCEC) selected for

delivery of the scheme.

Caterpillar’s regional sales manager

Adrian Grigorita appeared equally

buoyant about prospects for the region, despite its sporadic

pattern of investment.

He said, “There’s awillingnesswithinAlgeria for the continued

pace of growth there, whichhas been the case for about seven or

eight years.The constructionmarket inNorth Africa is actually

quite sophisticated –with it being close to Europe, it has access

to a lot of the same technical support.

“We have seen that the demand for excavators has increasedby

around +10% to +12% in the region with our 320D 20-tonne

model having been specially developed for North Africa. Our

950wheeled loader has also beenpopular.”

According to the senior salesmanager, oneof itsmost successful

breakthroughs had been the introduction of its grade control

system that improves efficiency of on-site equipment through

electronicmachine control.

In terms of Caterpillar’s most pressing challenges, he said the

drive towards more environmentally-conscious equipment with

tighter emissions controls would represent a challenge for many

contractors within the region.

P

olitical tensions are still high in parts of North Africa

including Libya and Egypt, and that is a problem

for construction investment. Despite that, there are

notable schemes under way that are set to improve the region’s

infrastructure and its ability to trade on an international level.

Among the largest of these is the expansion of Suez Canal

announced in August, which will increase capacity on this key

trade route. The first contracts for construction of the new

channel were awarded inOctober.

There has also been support from the Islamic Development

Bank in terms of providing finance for ventures including a new

phase of the SharmEl-Sheikh international airport inEgypt.

Elsewhere, schemes such as a new multi-billion Dollar high

speed rail link for Morocco, the 1,700km Ras Ejdyer coastal

highway in Libya and the long-planned Rades power station

in Tunisia that is being financed by the Japanese International

CooperationAgency–areall schemesdemonstratinggovernment

confidence indeveloping core infrastructure.

According to this year’s African Economic Outlook report

backed by the United Nations and the African Development

Bank, 2014will see the continent’s economic growthhit +4.8%.

Its forecast figures of +5% growth in 2015 are the strongest

seen since the economic crisis in 2009. According to the

study’s results, the region’s development has been driven by a

combination of domestic demand, infrastructure development

and an increase in international trade.

Despite the report’s positive tone, it highlighted anurgent need

to boost levels of high-value export goods if Africa's economies

are to deliver sustained long-term growth.

One country that has shown particularly strong performance

within the construction sector has been Algeria. Revenues

from its gas reserves have enabled considerable infrastructure

development over recent years.

According to research group Timetric, the country’s fortunes

have improved with government investment of US$ 286

Despite geopolitical

tensions, NorthAfrica

is investing in a range

ofmajor infrastructure

projects.

Neill Barston

reports.

Growth amid turbulence

Caterpillar’s equipment at

work on the Trans Sahara

Highway in Algeria.

Caterpillar’s Zhu

Jihon, parts and

supplymanager

for its Algeria

highway project

said contractors

BMAlgeria “have

given very good

support” for the

scheme.