FINANCE

15

CONSTRUCTION EUROPE

SEPTEMBER 2013

small losses against the British

Pound and Swiss Franc.

Elsewhere in Europe, the

Euro was up against both the

Norwegian Kroner and Swedish

Krona, along with the Hungarian

Forint. However, it lost some

ground to several key currencies

in central Europe, including the

Czech Koruna, Polish Zloty and

Romanian Lei.

OUTLOOK

Notwithstanding the gains for

the construction sector this year,

industry share prices are still

looking sickly compared to the

gains for some of the mainstream

indexes. It will take a more

convincing and prolonged global

economic recovery for the sector

to take-off, and that might be a

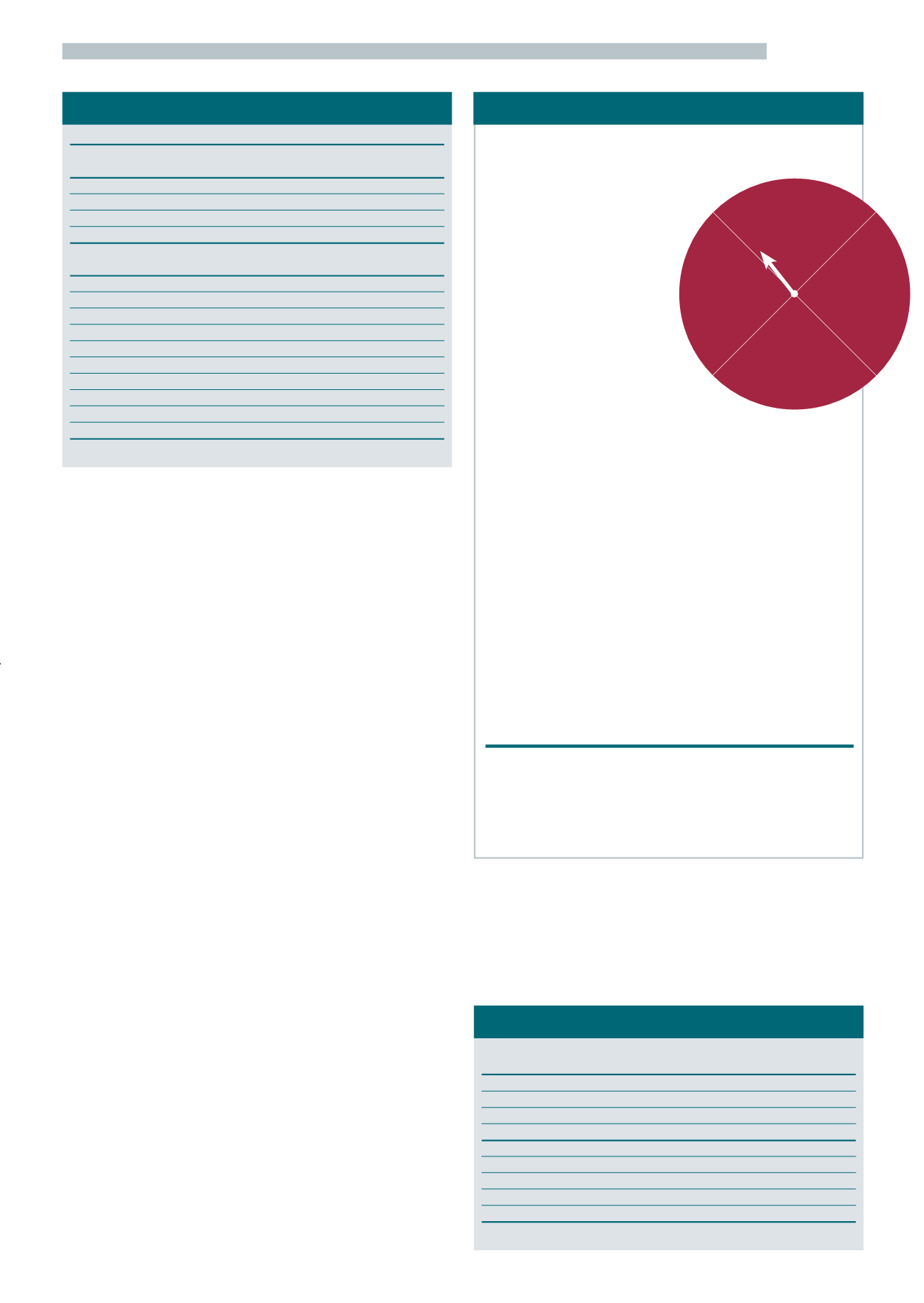

RESERVE CURRENCIES

Beginning

End

Change

Change

of period of period

(%)

British Pound

0.8581

0.8554

-0.0027

-0.31

Japanese Yen

129.25

131.96

2.72

2.10

Swiss Franc

1.2360

1.2343

-0.002

-0.14

US Dollar

1.2889

1.3340

0.0451

3.50

EUROPEAN CURRENCIES

British Pound

0.8581

0.8554

-0.0027

-0.31

Bulgarian Leva

1.9549

1.9556

0.0007

0.03

Czech Koruna

25.82

25.69

-0.137

-0.53

Danish Krone

7.4593

7.4594

0.0001

0.00

Hungarian Forint

294.22

298.93

4.71

1.60

Norwegian Krone

7.8843

8.1256

0.2412

3.06

Polish Zloty

4.2829

4.2403

-0.0427

-1.00

Romanian Lei

4.4383

4.4350

-0.0033

-0.07

Swedish Krona

8.6281

8.7191

0.0910

1.05

Swiss Franc

1.2360

1.2343

-0.0017

-0.14

Period: Week 27 - 34

Index

Beginning

End

Change

Change

of period of period

(%)

CEE (Equipment)

232.56

239.86

7.30

3.14

CEM (Materials)

139.16

145.04

5.88

4.22

CEC (Contractors)

129.17

138.99

9.82

7.60

CET (Total)

165.34

172.63

7.29

4.41

Dow

14989

14964

-25

-0.17

FTSE 100

6436

6433

-3

-0.04

Nikkei 225

14310

13661

-649

-4.54

CAC 40

3809

4033

224

5.89

DAX Xetra

8015

8378

363

4.53

Period: Week 27 - 34

VALUE OF €1

KEY INDEXES

Confidence ticks up

Results from the August

CE

Barometer

survey showed the strongest sentiment

in the industry for two years, but it

is too early to herald a full-blown

recovery

August saw some improvement

in European construction activity

according to the results of the

CE

Barometer survey. However,

the industry remained at a low

ebb compared to the position two

years ago.

It was the first time in almost two

years that respondents to the survey

were positive on all three measures of

confidence. A balance of +2.1% said they were busier in August

than the previous month, while +4.2% said they were busier than a

year ago and +30.2% said they expected activity levels to be higher

in a year’s time. The balance figure is the percentage of positive

responses, minus the number of negative ones.

The key turnaround was the response to the question about

activity levels compared to a year ago. This has been deeply

in negative territory since early 2012. Of the other confidence

measures, results about month-to-month activity have wavered

either side of 0 since mid-2011, but respondents have been

consistently positive about future prospects since the final quarter

of 2012.

As a result of these figures, the

CE

Climate, a composite measure

of confidence stood at +12.2%, the highest it has been since

August 2011, but some way from the levels of +25% or more that

have previously characterised a consistent market recovery.

It would also be dangerous to herald an industry recovery on

one month’s data. Experience has shown the

CE

barometer can be

susceptible to one-off peaks & troughs.

ce

CE

BAROMETER

long time coming for European

contractors relying on their weak

home markets.

Having

said

that,

this

summer’s improvements in

the construction sector’s stock

market performance have come

on the back of fairly lacklustre

results for the first half of the year.

Despite the uninspiring global

economic outlook, companies

are still managing to perform

and turn a profit.

The expectation that the

global economy will continue

to gradually improve should

continue to lift the sector.

However, with no ‘boom’ on the

horizon, it remains to be seen

what will happen with this

cyclical sector.

In previous years, industry

profitability (and therefore share

prices) have taken off on the

back of robust GDP growth. One

school of thought is that once

economic growth gets above a

certain level, capital investment

turns on to a level that really

lifts the construction sector, be it

contractors, materials producers

or equipment manufacturers.

However, with a gradual

recovery taking place, and the

expectation being for steady

but unspectacular growth in

the future, it remains to be seen

how investors will react. So far

this year the construction sector

has been flat on European stock

markets. Although there has

been some benefit from outside

the region, the continued fall in

European output has offset this.

Growth

in

share

prices

should come as the European

construction market recovers

The survey, which takes just one minute to complete, is open to all

construction professionals working in Europe. The

CE

Barometer

survey is open from the 1

st

to the 15

th

of each month on our

website. Please take part!

■

Full information can be found at

R

E

C

E

S

S

I

O

N

B

O

O

M

U

P

T

U

R

N

D

O

W

N

T

U

R

N

It was a mixed

few weeks on the

currency markets,

with the Euro

gaining good

ground against

the US Dollar

and Japanese

Yen, with small

losses against the

British Pound and

Swiss Franc.

– hopefully next year – but it

will not be a sharp swing back

to growth by any stretch of the

imagination. Even when the

European industry is back to ‘full

health’ growth in construction

output is likely to be weaker than

anywhere else in the world (with

the possible exception of Japan)

for the foreseeable future.

European

contractors

in

particular, are going to have to

continue to internationalise if

they want buoyant markets.

ce