FINANCE

Company

Currency Price

Price Change Change

at start at end

(%)

CEM Index

139.16 145.04

5.88

4.22

Buzzi Unicem (Ord)

€

12.22

11.29

-0.93

-7.61

Cemex (CPO)

MXP

13.71

15.88

2.17

15.83

Cimpor

€

3.15

3.10

-0.05

-1.59

CRH

€

15.78

16.29

0.51

3.23

Heidelberg Cement

€

51.07

54.61

3.54

6.93

Holcim

CHF

67.45

66.25

-1.20

-1.78

Italcementi

€

5.50

5.30

-0.20

-3.64

Kone (B)

€

63.20

62.40

-0.80

-1.27

Lafarge

€

47.52

47.40

-0.12

-0.25

Saint-Gobain

€

30.43

35.61

5.19

17.04

Schindler (BPC)

CHF

131.30 130.10

-1.20

-0.91

Schneider Electric

€

57.26

59.74

2.48

4.33

Titan Group (Common)

€

12.93

14.23

1.30

10.05

Vicat Group (Common)

€

46.66

51.76

5.11

10.94

Wienerberger

€

8.38

11.25

2.87

34.25

Wolseley

UK£

31.960 33.230 1.270

3.97

Period: Week 27 – 34

MATERIALS PRODUCERS

also been lifted by some major

contract wins. Most significant

of these was a US$7.8 billion

(€5.86 billion) contract to build

a section of the Riyadh, Saudi

Arabia metro system.

But not all the companies

that make up the CEC saw

their share prices rise over the

summer. Fallers included Bam,

Bauer, Tecnicas Reunidas, Trevi

and Veidekke, and these losses

limited the overall gains of the

index.

It was also a good few weeks for

the materials producing sector,

which saw a 4.22% gain to take

the CEM to 145.04 points. The

most significant drivers here

were double-digit gains for

some of the high capitalisation

companies,

namely

Cemex

and Saint-Gobain, while similar

strength from the likes of Titan,

Vicat and Wienerberger also

helped.

On the down side, there were

several fallers in the sector,

namely Buzzi Unicem, Cimpor.

Holcim,

Italcementi,

Kone,

Lafarge and Schindler, which

again took some of the shine off

an otherwise strong two months

for the sector.

The picture as perhaps a bit

more clouded among equipment

manufacturers, where the CEE

Index for the industry moved up

just 3.14% in the same seven

week period. On the face of it, this

looks to understate the strength

of the industry, with the likes

of Atlas Copco, CNH, Doosan,

Hyundai, Manitowoc, Palfinger

and Terex seeing double-digit

gains.

However, things were different

for several key high capitalisation

companies that dominate the

Index. Caterpillar, which accounts

for over 20% of the CEE, moved

sideways over the summer period

and Deere, which represents a

near-15% slice, was similarly flat.

Elsewhere, Komatsu, which is just

over 9% of the CEE was down

a little.

The only good news from the

high-capitalisation companies

was from among the Swedes,

with Atlas Copco, Sandvik and

Volvo adding some useful gains.

CURRENCIES

It was a mixed few weeks on the

currency markets, with the Euro

gaining good ground against the

US Dollar and Japanese Yen, with

€ 6078 million loss in its second

quarter results, driven by write-

downs for the bankruptcy of its

Austrian subsidiary, Alpine Bau

and regulatory changes at home

that hit its FCC Energy division.

However, since the results

announcement, FCC has found

a private equity buyer for Alpine

Energie and the company has

14

CONSTRUCTION EUROPE

SEPTEMBER 2013

make up the index saw their

share prices rise, and in some

cases – the likes of Bouygues,

FCC, Kier, Mota Engil and Sacyr,

the gains were striking, with

20% increases of greater. Most

remarkable was FCC, which saw

its value increase by two-thirds in

the seven week period.

FCC’s gains came despite a

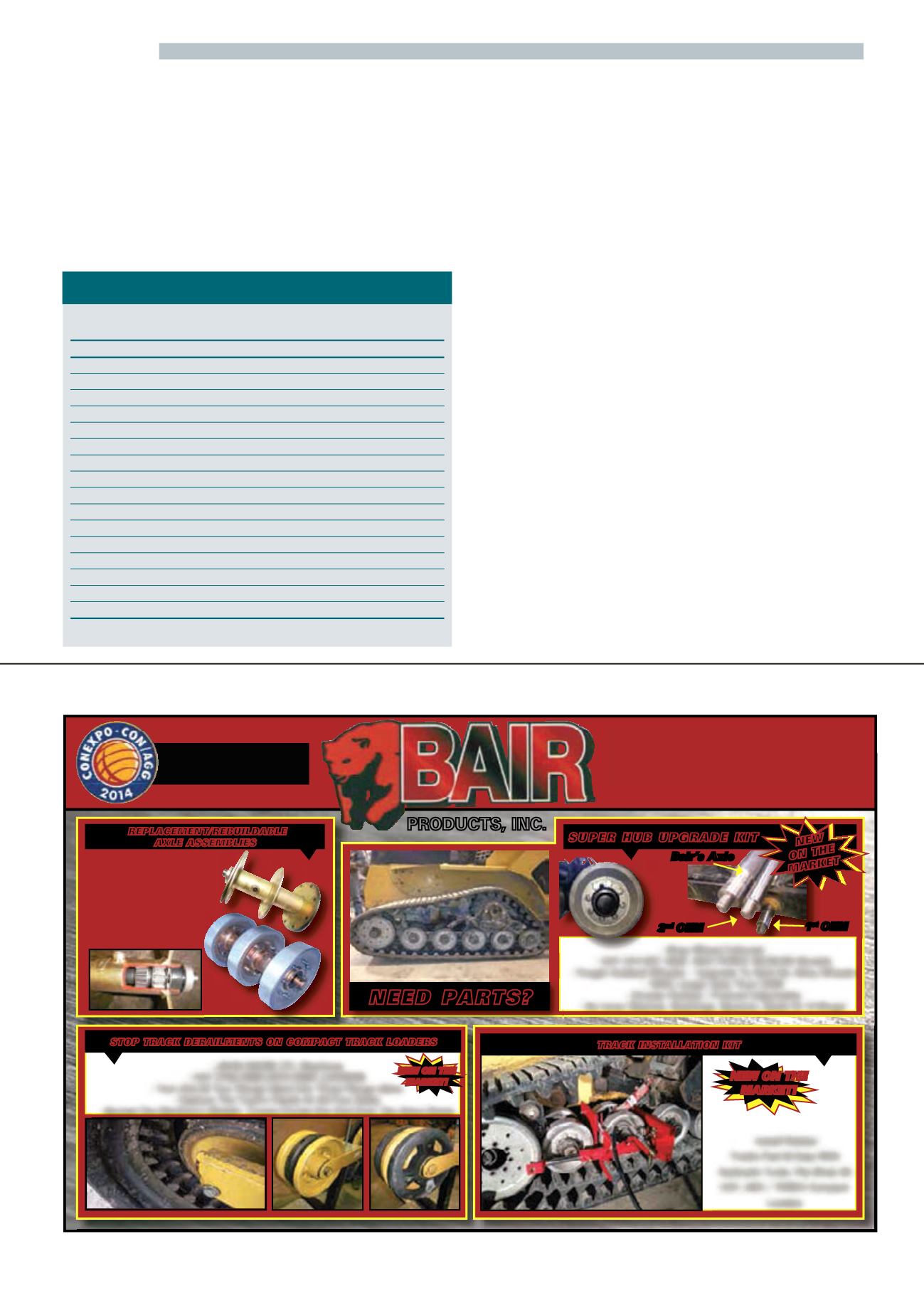

855-575-LUGS(5847)

TOLL FREE

•Grease Filled,

Not Oil

•Used With OEM or

Bair’s Alloy Wheels

•Rebuildable

•Idlers

Have Double

Stacked Bearings

REPLACEMENT/REBUILDABLE

AXLE ASSEMBLIES

STOP TRACK DERAILMENTS ON COMPACT TRACK LOADERS

• JOHN DEERE CTL Machines

• CAT 279C/289C/297C/299C LOADERS

• Turn One & Two Flange Idlers Into Three Flange Idlers

• Capture The Track’s Cleats At All Four Sides

• Spread The Machine’s Weight, Torque Forces Out And Over The Drive Cleats

TRACK INSTALLATION KIT

Install Rubber

Tracks Fast & Easy With

Hydraulic Tools, Fits Most All

CAT, ASV / TEREX Compact

Loaders

NEW ON THE

MARKET!

PRODUCTS, INC.

NEW ON THE

MARKET!

9 1 3 - 9 4 7 - 3 9 3 4

SUPER HUB UPGRADE KIT

Bair’s Axle

• Stop Wheel Failures!

• CAT 247/257 A&B, ASV/TEREX 30/50/60 Models

• Forget Hubbed Wheels – Upgrade To Bolt-On Alloy Wheels

• 100% Larger Axle Than OEM

• Grease Packed / Preload Adjustable

• No Inner Sleeves, Bushings, Spacers, Seals Or O-Rings!

2

nd

OEM

1

st

OEM

NEW

ON THE

MARKET

NEED PARTS?

BOOTH #40312

C2 CENTRAL HALL 2

Hablo Espanol +1 317-408-8260

English +1 913-947-3934