WORLD NEWS

■

Jeremy

Fish

has been

appointed as the

new managing

director of

Nationwide

Platforms, Lavendon Group’s UK

subsidiary.

He takes over from

Mike Potts

,

who resigned from the position in

the third quarter of last year. Mr

Potts joined the company in 2010

and left to pursue a new career

opportunity, said a spokesman.

Mr Fish has a strong background

in the rental industry in the UK

and international markets. He

worked for Aggreko from 2004

to 2012 in a number of senior

roles in North America, Eastern

Europe, and the Middle East. Most

recently he has been involved

with Ainscough Crane Hire in the

UK as a consultant, focusing on

the development of initiatives to

improve business performance.

■

Riwal has appointed

Nick

Field

as country

manager of

its German

operation. He

has extensive

managerial

experience through car rental.

PEOPLE

FINANCIAL HIGHLIGHTS

8

access

INTERNATIONAL

JANUARY-FEBRUARY 2014

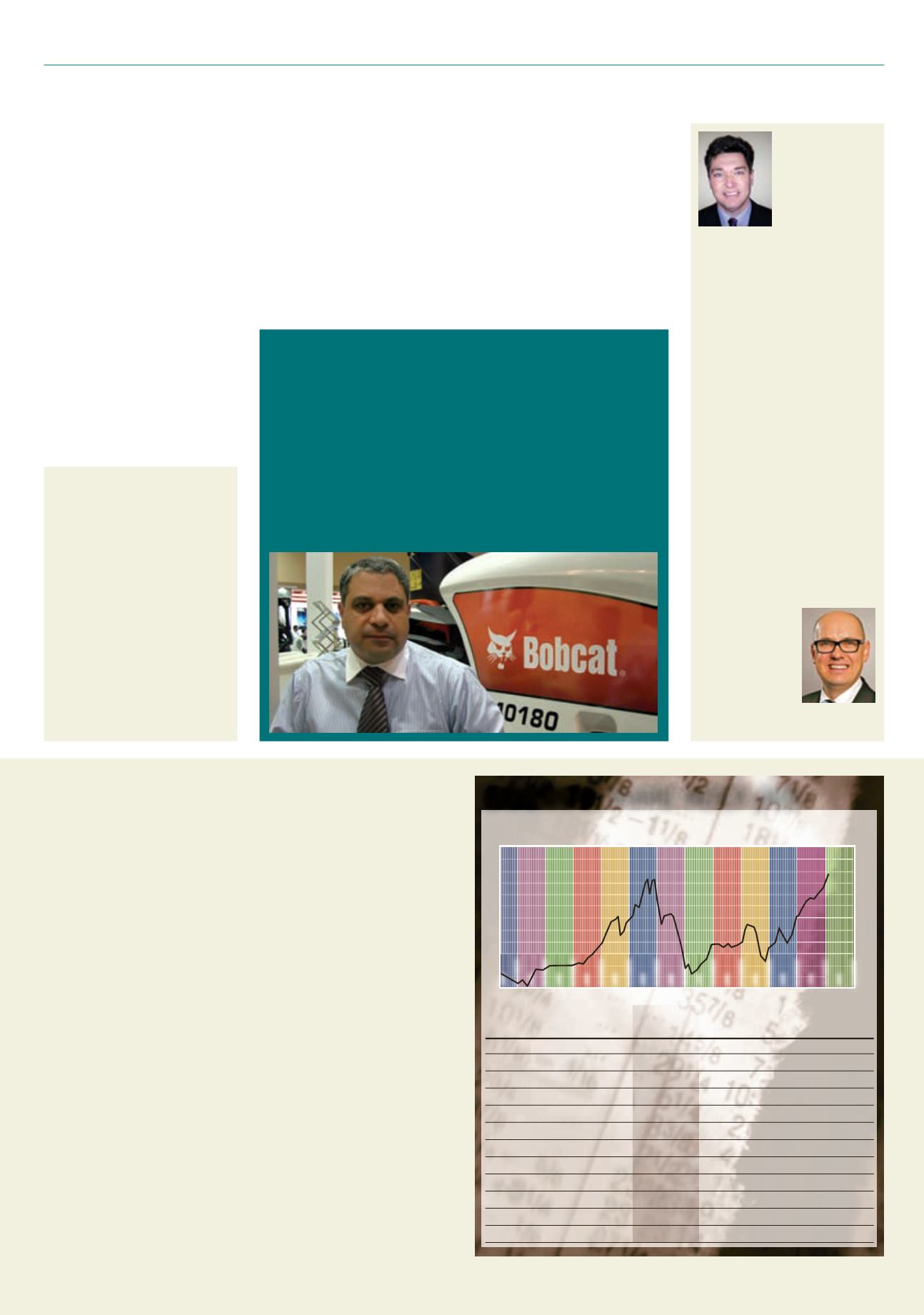

Company

Currency Start date Previous Current

%

21/6/02 11/09/13 24/01/14 change

Acces Industrie

€

1.34

2.42

3.20

32

Aichi Corporation YEN(¥)

208

489

467

-4.5

Ashtead Group

UK£

0.47

6.83

7.70

12.7

Kanamoto

YEN(¥)

–

2536

2725

7.5

Lavendon

£

1.85

1.75

1.95

11.4

Haulotte Group

€

9.00

9.35

10.54

12.7

Oshkosh Corp

US$

–

49.70

50.96

2.5

Tanfield Group

UK£

–

0.18

0.16

-11.1

Terex Corp

US$

23.08

34.78

37.92

9

Ramirent

€

15.00

9.56

8.90

-6.9

United Rentals

US$

21.47

64.78

79.50

22.7

ASI INDEX

100

434.31

483.51

11.3

access

SHARE INDEX (ASI)

21 June 2002 = 100 base

’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09 2010 2011 2012 2013

600

550

500

450

400

350

300

250

200

150

100

50

2014

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

JUNE

DECEMBER

■

Lavendon Group

has reported flat rental revenues for 2013 and said it was

confident that profit would reach expected levels, with growth in France and the

Middle East offsetting shrinking revenues in the UK, Germany and Belgium. In

Germany “teething issues” with the implementation of a new IT platform in the

third quarter led to a 13% fall in the final three months of 2013. It led to a 7%

reduction for the full year.

■

Ramirent

has slightly lowered its financial outlook for the full year 2013

following weaker than expected markets mainly in Finland and Norway during

the final quarter of the year. The company now expects 2013 EBITDA (profit

before interest, tax, depreciation and amortisation) to be around

€

92 million,

compared to the previous forecast of slightly below the

€

100.6 million achieved

in 2012.

■

Linamar’s

industrial division, which is largely made up by Skyjack, reported

a sales increase of 25.1% to US$127.6 million in the third quarter of 2013,

compared the same period in 2012. Operating earnings stood at $6.7 million or

an impressive 837.5% over the third quarter in 2012, when the figure stood at

$0.8 million. For the three months operating earnings stood at $46.8 million, up

from $22.3 million in 2012.

■

Ashtead Group

joined the FTSE 100 list of major UK stock exchange quoted

on Friday 20 December. The FTSE 100 is one of the key business lists in the UK

and Europe, comprising the top 100 capitalised business on the London Stock

Exchange. Ashtead has seen its share price increase steadily during 2013, from

around £4.30 at the start of the year to the current high of more than £7.70.

Bobcat has launched its 18 m reach T40180 telescopic handler at

the Intermat Middle East exhibition in Abu Dhabi, UAE. According to

the company’s regional director for the Middle East & Africa, Gaby

Rhayem, telescopic handlers are a small but fast-growing segment in

the region.

“The market [for telescopic handlers) is growing at 10% per year.

The Middle East is focussed on excavators, loaders and skid steer

loaders, but there is good growth in telehandlers and the market is

now around 550 machines per year.

“We are moving the mentality of our customers in the middle east

to more ‘fancy’ machines like telehandlers, mini excavators and

tracked loaders,” he said.

Palfinger takes double

Austria, and operates a

manufacturing and assembly plant

in Weng im Gesäuse, (Austrian

province of Styria), has so far

been owned by the Palfinger

family. Now the Palfinger Group

has acquired 85% of the company,

which generated revenue of about

€1 million in 2012, for a symbolic

purchase price of €1.

The Megarme Group,

comprised of three companies

in Dubai, Abu Dhabi and Qatar,

provides rope access technologies

and has an annual revenue of €15

million. Until now the Palfinger

has had no foot-hold in this

region of the world.

600

550

500

450

400

350

300

250

200

150

100

50

Palfinger has acquired two access

companies, specialising in offshore

and shipping: Palfinger systems in

Austria and the Megarme Group

in UAE.

Both companies offer

special systems for accessing

and performing repair and

maintenance work on ships and

oil rigs, including interior and

exterior cleaning, rust and paint

removal, recoating, inspection and

repairs.

Palfinger systems, which

is headquartered in Salzburg,

UK-based AFI has invested £2

million (US$3.3 million) in scissors,

booms and truck mounts.

Being part of AFI’s £7.2 million

($12.2 million) overall investment

in machines and delivery vehicles

for 2013, it includes 90 Skyjack

electric scissor lifts and 15 Genie bi-

energy boom lifts, and 13 new truck

mounted platforms for the Wilson

Access fleet.

The Skyjack scissor lift

investment comprises 50 SJ3219s,

30 SJ4632s and 10 SJ3226s, whilst

the Genie booms are all Z4525s.

AFI INVESTS IN

ELECTRIC