BUSINESSHIGHLIGHTS

SWITZERLAND

Holcim and Lafarge

renegotiate terms

Share exchange ratio adjusted asBruno Lafont

steps aside asCEO-designate

H

olcimandLafargehaveagreed revised terms for theirproposedmerger.

The deal will see Lafarge rolled into Holcim by means of a share

exchange. However, instead of the original one-to-one swap, the new

ratiowill be nineHolcim shares for tenLafarge shares.

In addition, current Lafarge chairman&CEOBrunoLafont will not now

head the new group as CEO.Hewill be co-chair with currentHolcim chair

Wolfgang Reitzle. The CEO for the new business will be nominated by

Lafarge at a future date andhas tobe approvedbyHolcim.

The changes to the deal follow a letter fromHolcim to Lafarge lastmonth

inwhich the Swiss company said it wanted to renegotiate the exchange ratio

andproposed leadershipof the company.

The rise in the valueof theSwiss Franc, alongwithHolcim’s better financial

performance during 2014 had meant the company had risen in value

compared towhen theoriginal dealwas struck a year ago.This hadprompted

keyHolcim shareholders topress for improvedmerger terms.

CANADA

Revenues affected

Aecon’s revenues for 2014 were

down -15% to CA$ 2.61 billion

(US$ 2.09 billion). Its net profit

more than halved from CA$ 47.8

million (US$ 38.3million) last year

to CA$ 21.8 million (US$ 17.5

million) in2014.

However, the company won an

“unprecedented” CA$ 3.5 billion

(US$ 2.8 billion) of new contracts

last year, which improved its

outlook. Its backlog stood at CA$

2.65 billion (US$ 2.13 billion) at

the end of the 2014 – almost +50%

higher than12months previously.

SWITZERLAND

Offer ruling

The Swiss Takeover Board (TOB)

has ruled the Burkard-Schenker

family can accept an offer for its

controlling stake in Sika from

Saint-Gobain, without the French

materials giant having to make an

offer to acquire all the shares in the

company.

However, the TOB has not ruled

on whether the deal is abusive, and

says it will only do so, should the

proposed transaction go ahead.

The Burkard-Schenker family

controls Sika through a holding

company,

Schenker-Winkler

Holding, which owns 16.4% of

Sika’s capital, but commands 52.6%

of its voting rights. In December,

Saint-Gobain

announced

a

CHF 2.75 billion (US$ 2.8 billion)

deal tobuy this controlling stake.

NETHERLANDS

Resultsdelayed

Ballast Nedam has withdrawn

its previous profits forecast for

2014, and will delay its results

announcement until 24April.

The company said the decision

was due to new losses on two road

buildingprojects in theNetherlands.

It had said in November that it

would make an operating loss of

€ 35million (US$37.9million), to

€ 45million (US$ 48.7million)for

2014, but now says full-year results

will be worse than this. It added it

still had the support of its banking

syndicate.

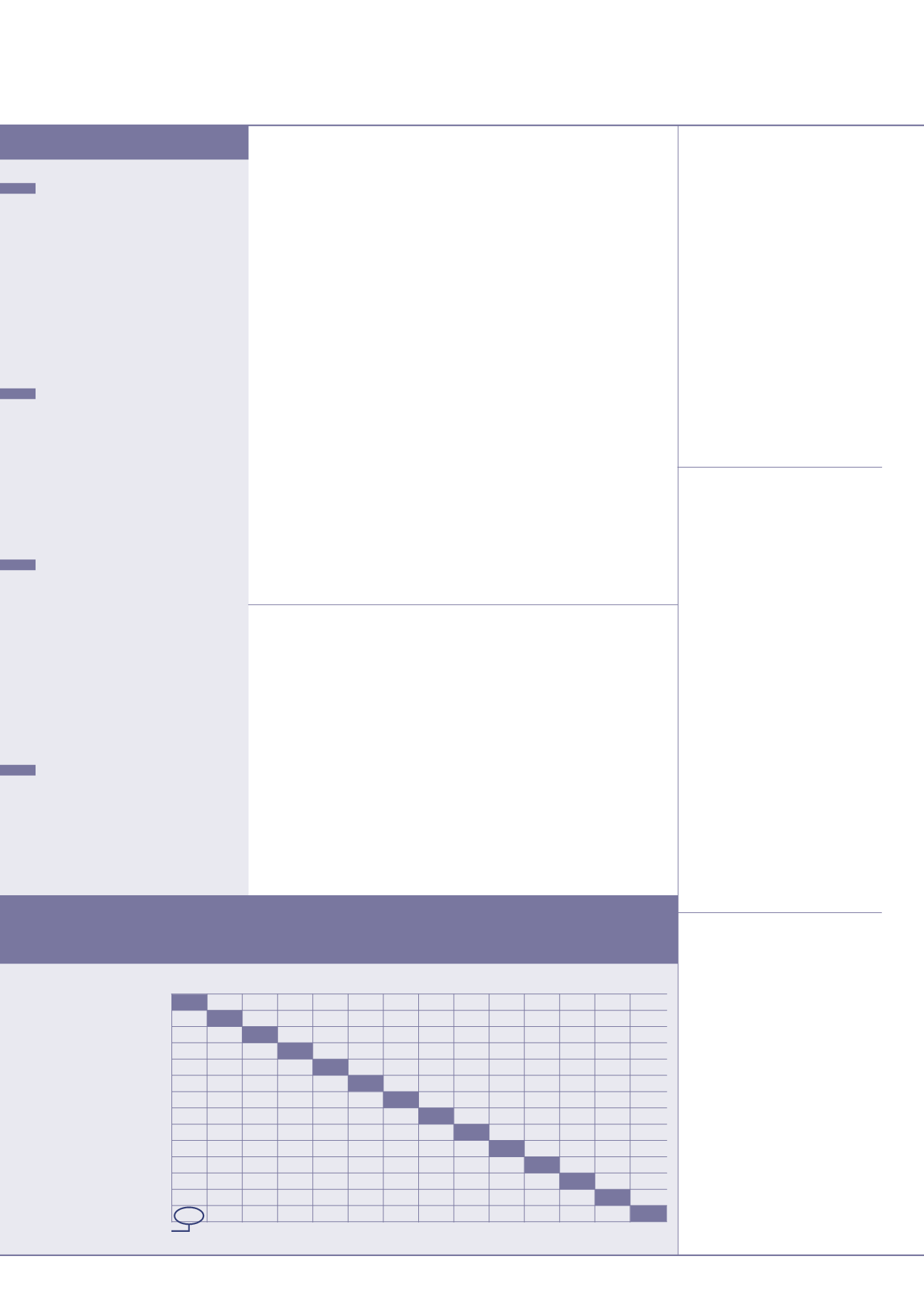

VALUEOF 1:

SYMBOL AU$

BRL

UK£ CNY

€

INR

YEN MXN RUR SAR

ZAR KRW CHF

US$

AustralianDollar

AU$

0.40 0.516 4.74 0.704 47.7

92

11.62 44.1

2.86

9.27

844 0.736 0.763

BrazilianReal

BRL

2.49

0.207 1.91 0.283 19.2

36.8

4.67

17.7

1.15

3.73

339 0.296 0.307

BritishPound

UK£

1.94

4.82

9.2

1.36

92.5

177

22.5

85.4

5.55

18.0

1636 1.43

1.48

Chinese Yuan

CNY

0.211 0.525 0.109

0.148 10.07 19.3

2.45

9.30 0.604 1.957

178 0.155 0.161

Euro

€

1.42

3.53

0.73

6.73

67.8

130

16.5

62.6

4.07 13.18 1199 1.05

1.08

IndianRupee

INR

0.021 0.052 0.011 0.099 0.015

1.9

0.244 0.924 0.0600 0.194 17.7 0.0154 0.0160

Japanese Yen

YEN

0.011 0.027 0.006 0.052 0.008 0.521

0.1269 0.482 0.0313 0.1013 9.2 0.0080 0.0083

MexicanPeso

MXN

0.086 0.214 0.044 0.408 0.061 4.11

7.88

3.79 0.246 0.798

73

0.063 0.0657

RussianRuble

RUR

0.023 0.056 0.012 0.108 0.016 1.08

2.08 0.264

0.065 0.210 19.1 0.0167 0.0173

Saudi Riyal

SAR

0.349 0.869 0.180 1.656 0.246 16.667 31.971 4.059 15.400

3.24

295 0.257 0.267

SouthAfricanRand ZAR

0.108 0.268 0.056 0.511 0.076 5.144 9.867 1.253 4.753 0.309

91

0.079 0.082

SouthKoreanWon KRW

0.0012 0.0029 0.0006 0.0056 0.0008 0.0565 0.1084 0.0138 0.0522 0.0034 0.0110

0.00087 0.0009

Swiss Franc

CHF

1.36

3.38

0.70

6.44

0.96 64.83 124.37 15.79 59.91 3.89 12.60 1147

1.037

USDollar

US$

1.31 3.258 0.676 6.209 0.922 62.5 119.9 15.22 57.75 3.75 12.15 1105.84 0.964

For exampleUS$ 1=AU$ 1.31

Exchange rates: March 2015

CHINA

Lafarge has acquired the 45%

stake held by Shui OnConstruction

AndMaterials (SOCAMDevelopment)

in Lafarge Shui OnCement. The deal,

worthHK$ 2.55 billion (US$330

million), is subject to the completion of

Lafarge’smerger withHolcim. Lafarge

Shui OnCement has facilities in

SouthWest China, in the provinces of

Yunnan, Sichuan, Guizhou and the city

of Chongqing, inSichuan Province.

UK

Full-year losses at Balfour Beatty

have included a further UK£118million

(US$ 175million) write-down in its UK

construction business. However, the

company’s international construction

revenueswer up+24% at constant

exchange rates toUK£1 billion (US$

1.48 billion), predominantly as a result

of a joint venture inHongKong.

NETHERLANDS

VanOord’s 2014

revenueswere up+28%, to a record

€

2.1 billion (US$ 2.27 billion). The

company’s net profit for 2014was

€

119million (US$ 129million),

comparedwith

€

130million (US$

141million) for 2013. Its order book

increased to a record

€

3.2 billion

(US$ 3.5 billion) at the end of 2014,

compared to

€

1.9 billion (US$2.06

billion) at the end of 2013.

US

CNH Industrial’s sales of

construction equipment came to

US$ 3.35 billion last year, an increase

of +2.7% on 2013. Operating profit

from the divisionwas US$ 79million,

compared to the loss of US$97million

recorded in 2013.

international

construction

april 2015

BUSINESSNEWS

10

AUSTRALIA

Leighton seeksname changeapproval

Leighton Holdings is to seek

approval from shareholders to

change its name to CIMIC Group

(Construction

Infrastructure

Mining and Concessions). The

move follows a turbulent period for

the business in which it has faced

corruption allegations, a law suit

relating to a profit downgrade and

has reshaped the company through

a string of divestments.

A statement from Leighton said,

“The board considers that the

change of name is appropriate to

support the transformation to the

new operating model. The new

name intends to provide a better

representation of what we are and

do, and this will closely reflect our

core activities.”

The company's Board has

approved the name change, which

will be put to a vote at Leighton’s

AGM later thismonth.