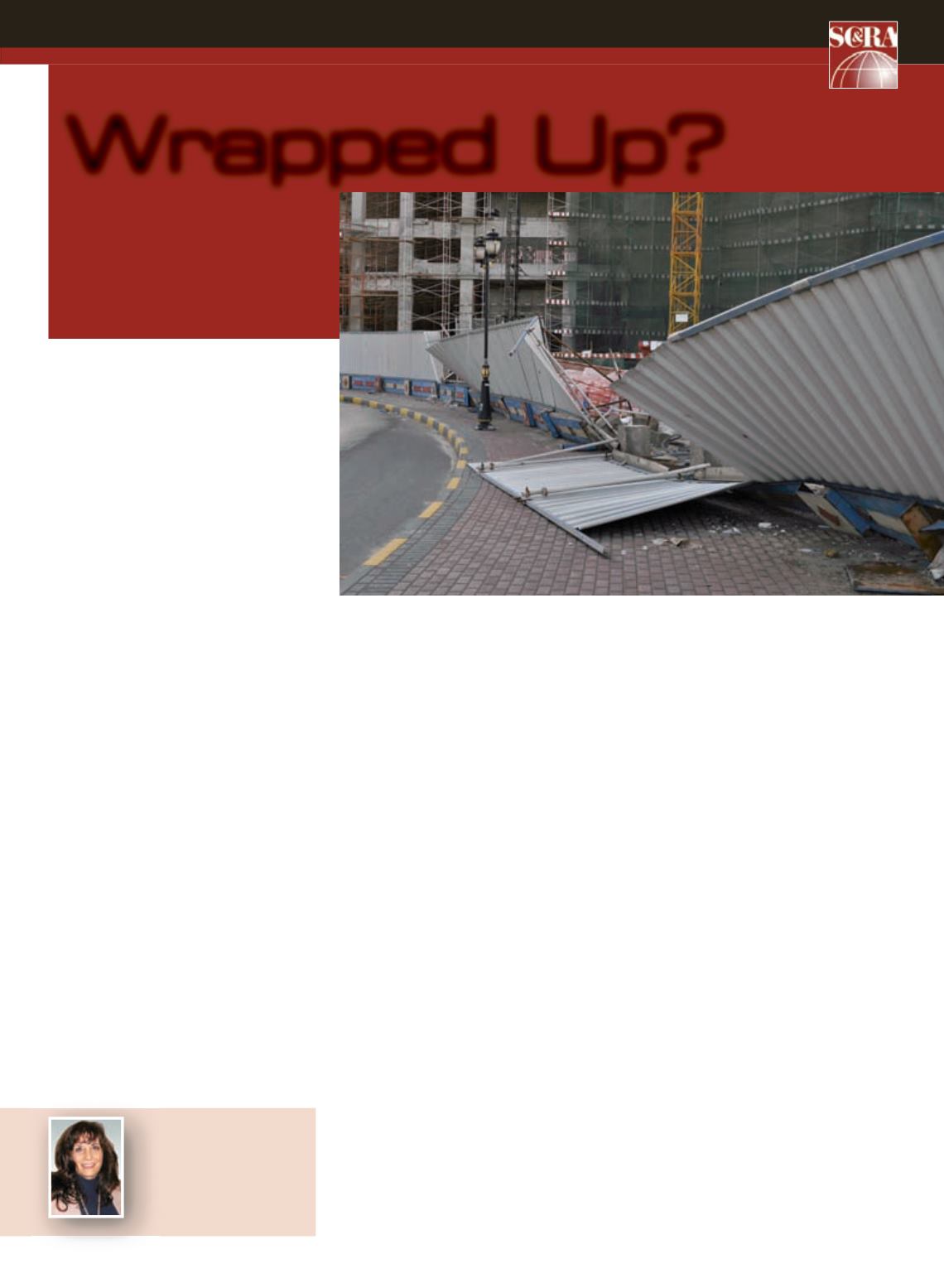

RISK MANAGEMENT

Michelle Lorenz

answers

the question: Does a

Wrap-Up Policy protect my

crane company?

59

DECEMBER 2013

ACT

I

n this litigation-crazed era, when

workers are injured on a construction

site, not only do they collect against

a worker’s compensation policy but they

often they attempt to sue multiple parties:

Project Owners, Project Managers,

General Contractors and many of the

subcontractors on the site. In response

to this, many owners, contractors and

municipalities resort to insurance

alternatives such as OCIPs or CCIPs,

which are types of Wrap-Up Policies.

What is an OCIP, CCIP or Wrap-

Up? A Wrap-Up is an insurance policy

that consolidates or “wraps up” all the

insurance on a construction project

under one insurance program. It provides

uniform coverage with high limits for all

companies enrolled in the Wrap-Up and

working at the construction site. Instead

of having a typical one year policy term,

the Wrap-Up policy lasts the life of the

construction project, most often ranging

from two to five years. They can cover

only one specific construction site or

multiple sites. Wrap-Ups can include

various types of insurance but the most

common purchased are: 1) a first-party

Builders Risk policy for damage to the

ongoing construction, 2) a worker’s

compensation policy that covers injuries

to employees of any contractor on the

site, and 3) a third-party general liability

policy that covers property damage or

bodily injury claims that occur on the site.

Additionally, there is typically a significant

layer of umbrella or excess coverage with

at least $50 million up to amounts of

several hundred million in limits.

Both OCIPs and CCIPs are types of

Wrap-Up policies. OCIP stands for

Owner Controlled Insurance Program

where an owner buys & administers

the insurance program; a CCIP is a

Contractor Controlled Insurance Program

where a contractor (generally the GC)

purchases and administers the Program.

While OCIPs and CCIPs have been

around for more than 40 years, they are

increasing in popularity because of large

capital improvement projects, big energy

projects like wind farm work, as well as

increasingly strict anti-indemnity statutes

and the risks of tenders not being accepted

by the carrier for a contracting party.

A Wrap-Up Program Administrator

often requires all subcontractors working

on a site to participate in the OCIP or

CCIP. However, crane companies are often

given the option of whether they want to

participate. Let’s review common coverage

gaps in Wrap-Ups as well as some things

you should discuss with your agent before

participating financially in a Wrap-Up.

Gaps/traps of Wrap-Ups

Participating in a Wrap-Up insurance

program can be a great alternative for a

crane company because of the protection

of one’s own loss history, higher available

limits and the ability to insulate the

crane company from subrogation claims

by other subcontractors enrolled in the

Wrap-Up. But, if you participate, you

need to understand the gaps in general

liability insurance coverage provided by a

Wrap-Up. Wrap-Up coverage is typically

provided with a standard insurance

industry policy form entitled CG 0001.

But crane companies need unique

coverage’s that your own GL carrier should

provide via endorsements that modify the

coverage in the CG0001 form. Wrap-Ups

don’t have this additional protection for

crane companies. Following are the most

common gaps in coverage:

HOOK COVERAGE.

If you drop and damage a

load you are lifting, the Wrap-Up has no

coverage for that property damage or the

lost profits emanating from the property

damage. This could be a several million

dollar claim.

CONTRACTOR’S EQUIPMENT.

Wrap-Ups have

no coverage for contractor’s equipment.

If you are erecting a tower crane and it’s

damaged during that process, the Wrap-

Up has no coverage for the property

damage or lost profits that result from

that.

POLLUTION COVERAGE.

The CG0001 form

has a standard exclusion for pollution

claims & thus a Wrap-Up has no coverage

for most pollution claims. Many crane

policies have limited pollution coverage

for “sudden & accidental” exposure or

pollutants such as hydraulic fluid that leak

from a piece of mobile equipment. Wrap-

Ups don’t.

Wrapped Up?

ABOUT THE

AUTHOR

Michelle Lorenz

is

manager of litigation and

claims for NBIS.