14

COATESHIRE INTERVIEW

IRNAPRIL-MAY 2014

Leigh Ainsworth is one of the keynote speakers at the

International Rental Conference (IRC) in Shanghai, China

on 24November, 2014, the day before the Bauma China

exhibition. For details, seewww.khl.com/irc

explains Mr Ainsworth, “It’s a strange thing for a

rental company to say, but if you get their trust, you

benefit over the longer term. Of course we can also

say it’sbetter to rent thanown.”

The company may have sold its Aberdeen oil and

gas business, but Mr Ainsworth says Coates is still

on the acquisitions trail, only closer to home. “We’re

always in the acquisitions market – sometimes a

stressed market pops up some opportunities. The

last time there was a downturn we made some

acquisitions.” Last summer it acquired the non-

access activitiesof ForceAccess, a small deal.

He says speciality rental businesses would be the

preference – not least because they have no need

for additional general fleet – and also says that

opportunities are likely to be domestic rather than

in wider Asia, for example; “When you

have opportunities at home you drive

past business getting there [tooverseas

markets].”

Depot network

Thedepot network requiresnooverhaul,

other than the usual opening and

closures associated with changes in

local activity levels, so no big hub and

spoke projects of the kindbeing seen at

rental companies in theUSandUK.

The size of the country means that

a lot of depots are required to give

national coverage, andCoates hasmany

large generalist stores stocking pretty

much everything because it might be

500km to thenext specialist store.

And in the tool and equipment business, the stores

areprettymuchessential; “Close to 70%of thework

wehavewedidn’t knowweweregoing toget theday

before”, saysMr Ainsworth.

Coates ownership has also been on the agenda in

recent years, with joint major shareholders Seven

GroupandCarlyleannouncing last summer that they

would retain ownership after a six month review

of the business. The feeling is that this topic will

reappearwhen theyareable toattract abetterprice.

If this is unsettling, Mr Ainsworth’s demeanour

suggests otherwise; “It doesn’t really make a

big difference – we just run the business and the

shareholdersdo thebest they can.”

In any case, he has other concerns for a business

that remains in a transitional period: waiting for

payback on the efficiency projects, waiting formajor

infrastructure contracts to start, and, of course,

keeping a close eye on the prices of ironore, natural

gas and coal.

IRN

Australia. We’re still investing, but puttingmore into

specialist products, growing theseareas.”

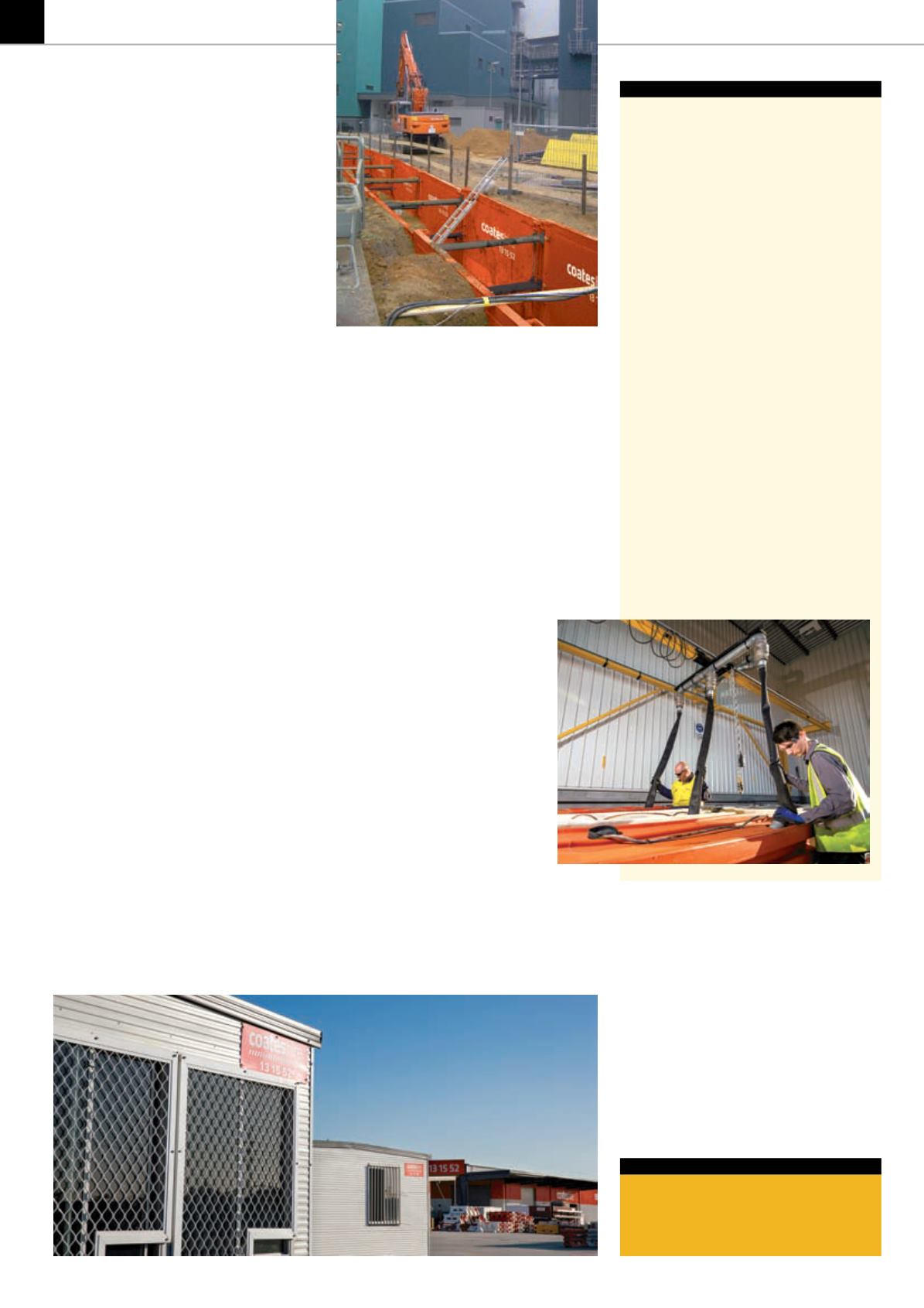

These include shoring equipment – such as large

hydraulic struts that it is buying from UK rental

company Groundforce – traffic control, pumps and

environmental equipment, such as water recycling

products. There isalsostill demand forCoates’ power

rental fleet, which is focused on mid-sized units

rather than the 1MWplus sector.

Aerial platforms

Coates remains one of the largest owners of aerial

platforms in Australia: asked if the company is

interested in buying the massive new JLG 185 ft

booms, Mr Ainsworth is positive; “I think we will. We

bought the 1500s as soon as they were available,

so it would be a natural thing. They are expensive

machines, sowill never be a big part of the fleet. We

need to talk to customers and make sure there is a

demand first.”

He says the 185 ft units would potentially be very

useful for some of the LNG plants that are currently

being completed.

Capital expenditure may be more selective than

in the past, but Coates has still managed to invest

heavily invariousprojects tobecomemoreefficient.

“During any period when revenue is constrained,

attention turns tocost andefficiency, that’sanatural

shift in focus”, he says. “We’ve really invested in

business improvement projects over the past four

years [around A$30 million]. We do expect to get

returns – someareyieldingquitewell already.”

These include a shift to paperless working, using

bar codesonproducts todigitise service recordsand

the like. Around 70-80%of the fleet is nowbarcoded

and Mr Ainsworth says the company is still only

getting 20% of the benefits; “We’ll get to 75-80%

next year.”

Coates has also invested in the PROS price

optimisation system. “That’s the same. We’ve done a

lot of work over the past few years and we are now

rolling it out. Wehope to seeyield from that over the

next few years. It’s really about giving guidance to

the branches, the ability to change prices quickly.”

He says it also makes it easier to review pricing on

annual contracts.

As at other big rental companies, Coates is aiming

to provide more data to customers, particularly its

major accounts, which is in part a reflection of a

more mature relationship. “We have told customers

in some cases that it is better to buy than hire”,

Safetypayback

LeighAinsworth says CoatesHire’s successful

campaign to improve its safety recordhas cut

itsworker compensationpayments by asmuch

as 40%, saving itmillions of dollars and creating

abetter culture at the company.

“Youdo it bynot having accidents”, he

deadpans. “Youhave tobe serious about safety

and convince the leadership thatwe are serious

about it...Ultimately a fewpeoplehad to lose

their jobs for doing things thatwereunsafe.”

He says abigpart of the success is adifferent

attitude tounsafepractices; “It takes a long

time to change a culture. In the end, a company

cando somuch. Peoplehave to care about

themselves and their friends and colleagues.

“We are seeing that peoplewill report unsafe

practices, andwill go to friends and colleagues

and say ‘that’s not safe’. Now, peoplebelieve

that Coates cares about their safety. People

accept absolutely thatwedon’t expect them to

work if itmeans doing somethingunsafe.”

He says Coates looked at areaswhere there

were safety risks, such as using lathes in the

workshops; “Wedecided that if we can’t do it

safely, we saywe just don’t do it.”

Lathework has nowbeenoutsourced to

specialist engineering companies. “It’s not

convenient”, saysMr Ainsworth, “but it’s safer.”

Coates staff using

personal protective

equipment.

Shoring equipment, like these standard 5m boxes, are an area of

investment by Coates, including large hydraulic struts imported

fromGroundforce in the UK.

Portable accommodation units

form part of Coates’ rental fleet.