BUSINESS NEWS

13

INTERNATIONAL AND SPECIALIZED TRANSPORT

■

AUGUST 2013

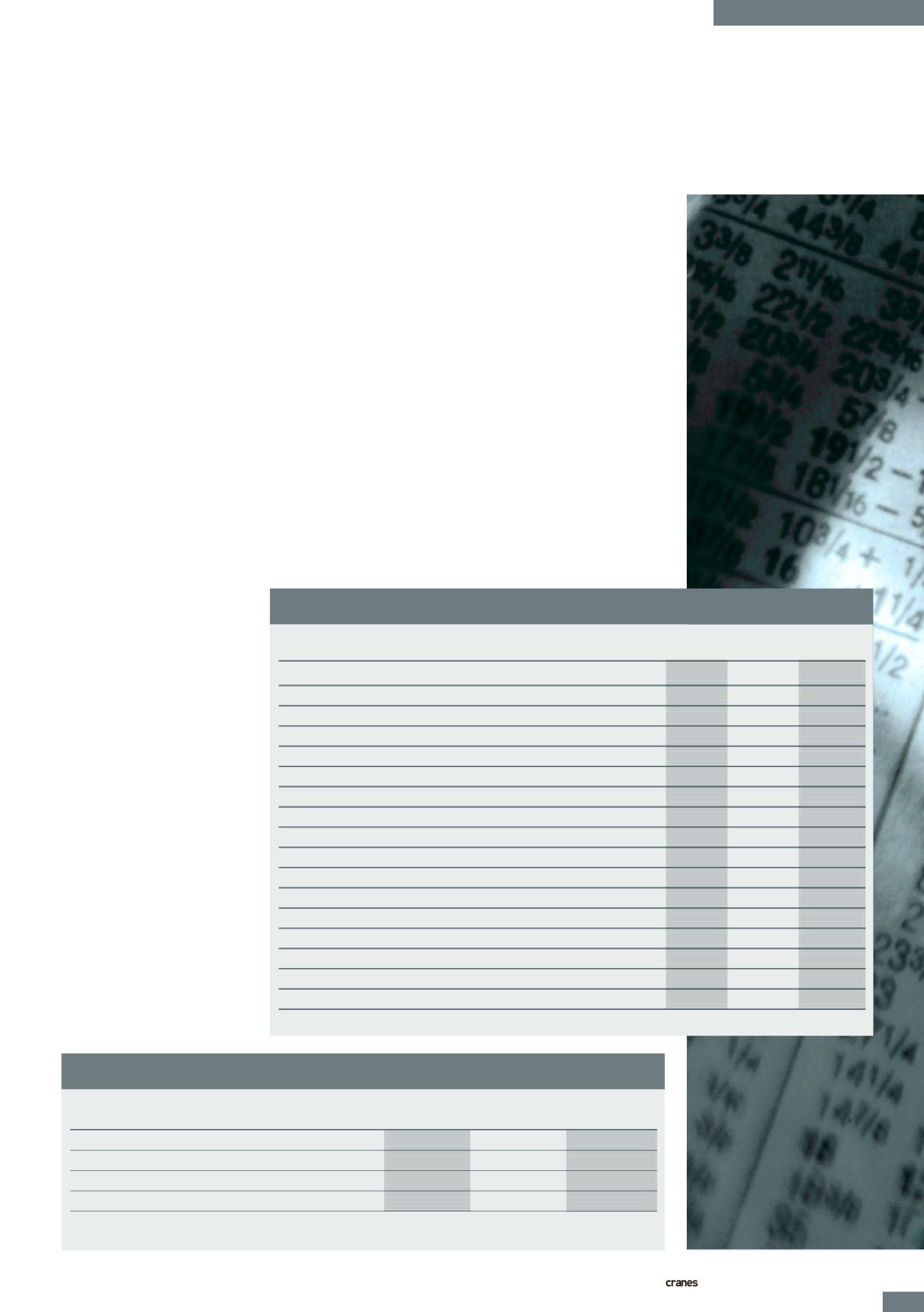

STOCK

CURRENCY

PRICE

PRICE CHANGE

%

PRICE 12

12 MTH

AT START AT END

CHANGE MTHS AGO % CHANGE

IC

Share Index*

54.24 54.63

0.39

0.73

62.84 -13.06

Legacy IC Share Index**

309.15

333.20

24.05

7.78

237.64

40.22

Dow Jones Industrial Average

15024

15559

534.34

3.56

13075.66

18.99

FTSE 100

6243

6596

352.60

5.65

5655.78

16.62

Nikkei 225

13677

13661

-16.19

-0.12

8635.44

58.20

Hitachi Construction Machinery YEN

2038

2037

-1

-0.05

1402

45.29

Konecranes

€

22.67

22.95

0.28

1.24

20.59

11.46

Kobe Steel

YEN

122

145

23

18.85

73

98.63

Liugong

CNY

6.50

6.08

-0.42

-6.46

11.36

-46.48

Manitowoc

US$

17.99

19.11

1.12

6.23

12.08

58.20

Palfinger

€

21.75

23.70

1.95

8.97

16.06

47.57

Sany Heavy Industry

CNY

7.49

6.84

-0.65

-8.68

11.97

-42.86

Tadano

YEN

1277

1383

106

8.30

549

151.91

Terex

US$

26.93

28.49

1.56

5.79

19.15

48.77

XCMG

CNY

7.79

7.35

-0.44

-5.65

12.54

-41.39

Yongmao Holding

SGD

0.11

0.17

0.06

50.00

0.10

60.19

Zoomlion

CNY

5.39

5.01

-0.38

-7.05

9.59

-47.76

*IC Share Index, 1 Jan 2011 = 100

**Legacy IC Share Index, end April 2002 (week 17) = 100

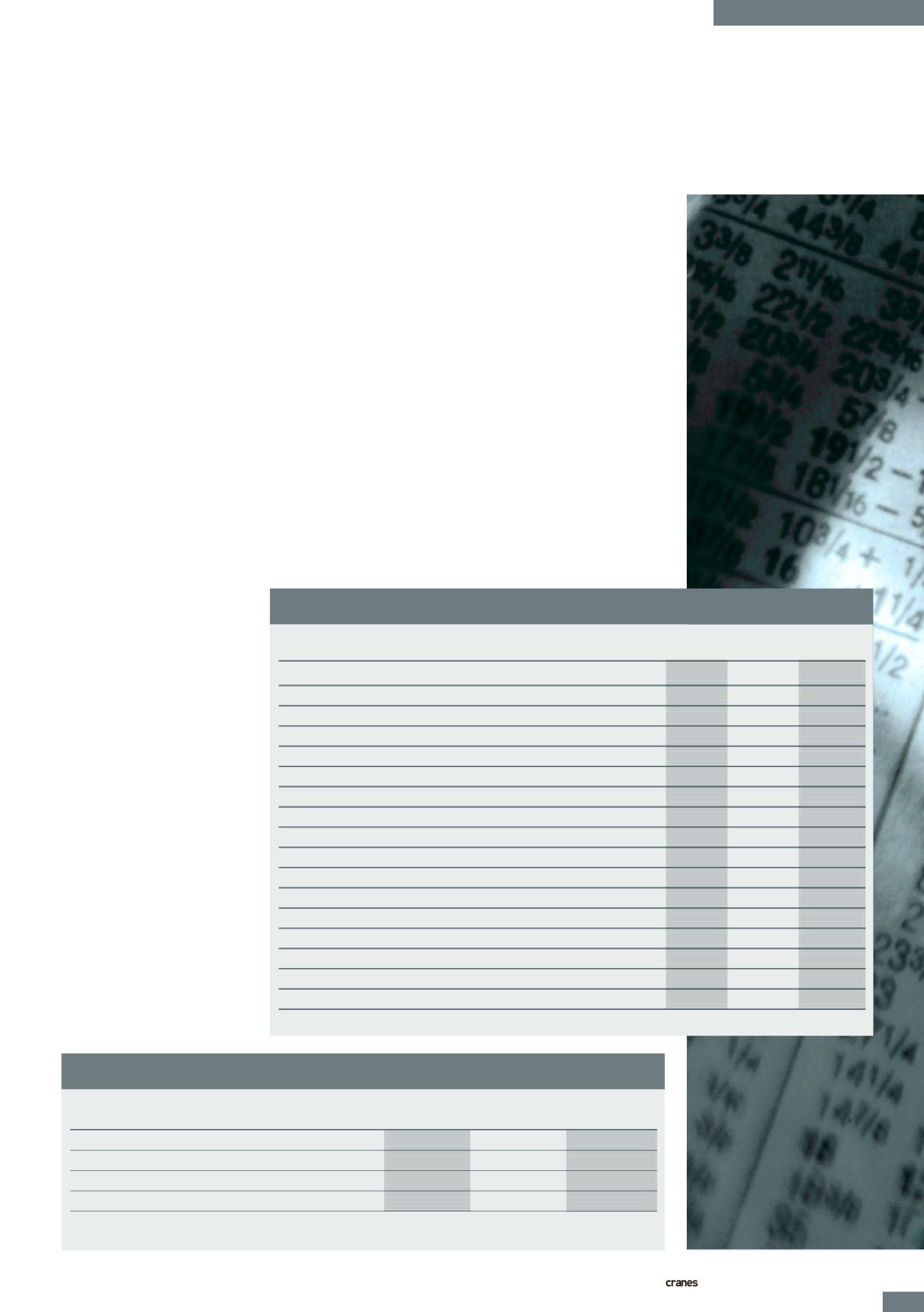

JULY IC SHARE INDEX

CURRENCY

VALUE

VALUE

CHANGE

% CHANGE

VALUE 12

12 MTH

AT START

AT END

MTHS AGO

% CHANGE

CNY

6.169935

6.1346

-0.0353

-0.57

6.38069

-3.86

€

0.6550

0.6501

-0.0049

-0.75

0.6257

3.91

Yen

98.76

97.97

-0.78

-0.79

78.18

25.32

UK£

0.7654

0.7537

-0.0117

-1.53

0.8119

-7.17

Period: Week 26 - 30

EXCHANGE RATES – US$

Chinese impact

manufacturers, was up 7.78 %.

This was driven by the general

buoyancy of the markets

and reflected the continued

economic recovery in the USA,

among other factors.

Trouble ahead

Clearly the Chinese market

continued to drag on share

prices in the crane sector

over the course of July and

the greatest impact was seen

on domestic manufacturers.

Although the Chinese

construction market appears

to be growing again after the

downturn of 2011 and 2012,

there is still a lot of relatively

young machinery available

from the boom years.

The stock markets

resumed their

climb in July,

but it was all the

IC

share index

could do to stand

still, thanks to

weakness in

China. CHRIS

SLEIGHT reports

This is hitting new

equipment sales, and there is

also anecdotal evidence that

some manufacturers are still

producing too many machines,

which are being pushed out

into the market on loose credit

terms. This could mean more

trouble is being stored up in

a sector that is already

suffering from weak sales

and low morale.

It is difficult to say to

what extent these dangerous

commercial practices are going

on – if they are going on at

all. However, it is a worry

for the sector, and could

ultimately lead to bankruptcies

among manufacturers and /

or distributors.

■

S

tock markets around

the world enjoyed a

fairly positive month

in July, with the Dow reaching

new highs and the FTSE 100

putting on a useful 5.65 % gain

between weeks 26 and 30. The

previously buoyant Nikkei 225

slipped a marginal 0.12 %, but

given it had risen some 60 %

in the previous 12 months, this

could perhaps be forgiven.

IC

’s share index moved

up just 0.73 % in the week

26 to 30 period, a marginal

movement and a symptom

of the weakness that has seen

the index lose 13.06 % of its

value over the last year. The

problem, as has been the

case for some time, was with

China’s crane manufacturers,

which saw their share prices

fall again, in some cases, to

new lows.

Zoomlion, for example,

had not seen its shares this low

since 2006, and the picture was

similar for Sany and several

other key players in the sector.

The week 26 to 30 period

saw both companies suffer

heavy losses, dropping 7.05 %

and 8.68 % respectively, with

Liugong not far behind with

its 6.46 % slide. These were the

heaviest losses on the

IC

Share

Index during July.

Economic recovery

Elsewhere in the Index, crane

manufacturers generally

saw their stocks rise. The

Legacy

IC

Share Index, which

is an older measure of the

sector’s stock market value,

and which excludes China’s