18

ACCESS, LIFT & HANDLERS

JULY-AUGUST 2013

SCAFFOLD

20

SCAFFOLD

20

survey details

Research for the SCAFFOLD

20

was conducted in the Spring 2013. Where companies were

unwilling to provide data, we made our estimates based on advice from annual reports and industry

contacts. We thank those companies and individuals who provided information.

If you would like to be included in next year’s SCAFFOLD

20

, please contact editor Lindsey

Anderson at

or by calling (312) 929-4409.

Many companies and contractors are citing

gains from the ongoing construction of power

plants, refineries and bridges to the repair

and restoration of historic buildings – in short,

widespread demand across many markets.

While the collapse of the housing market and

the succeeding economic recession brought

construction activity in most markets to a near

halt, the scaffolding industry is recovering at a

modest clip.

The industry’s recovery started in 2011

and gained momentum in 2012. According

to IBISWorld’s Scaffolding Contractors in the

U.S. report, industry revenues are expected to

grow 11 percent in the next year, boosted by

resurgence in construction activity, primarily

from residential markets. Continued recovery

in downstream construction markets will help

the industry return to growth in the five years

to 2017.

During the five years leading up to 2012,

residential construction slumped to historic

lows, dropping at an average rate of 9.8 percent

per year to about $349.5 billion in 2012,

as foreclosures, declining home prices and

tightening credit standards contributed to soft

housing demand conditions. Non-residential

construction, the industry’s largest revenue

generator, also declined at an average annual

rate of 5.4 percent to about $332.8 billion in the

five years to 2012, the report notes.

Reduced corporate profit, high unemployment

and low consumer spending weakened demand

for new office, retail, and industrial spaces, in

turn, hurting demand for scaffolding contractors.

“The industry experienced declining revenue

from 2007 through 2011 with the steepest

decline of 20.4 percent occurring in 2009 during

the peak of the recession,” the report states.

With the recession coming to a close for the

industry, though, the SCAFFOLD

20

mirrors an

industry that’s on the brink of flourishing. Will it

hit $4 billion total next year? We’ll have to wait

and see.

■

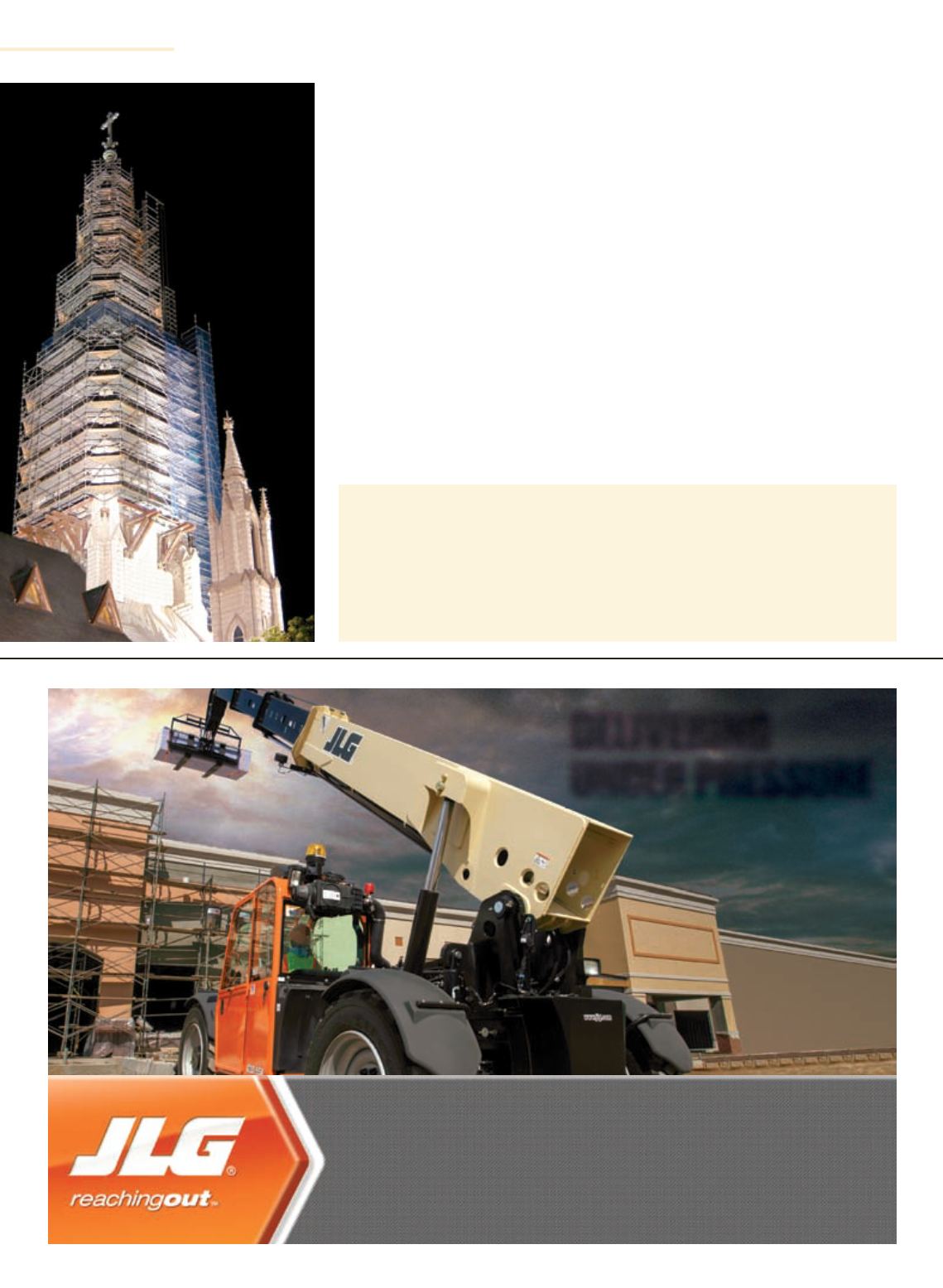

Peterson Industrial Scaffolding

of St. Louis was called in

to scaffold the interior and

exterior of St Alphonsus

Church so repairs could

be made to the church’s

spire after it was

struck by lightning.

When the pressure’s on, the lineup of JLG

®

all-wheel steer telehandlers gives you all the

power, reliability and maneuverability you need. New Tier 4i engines give you greater fuel

efficiency and reduced noise. With the greatest model range—from 5,500 lb to 12,000 lb

capacity—and the most extensive distribution and service network, JLG telehandlers

won’t let you down. See JLG telehandlers at YouTube.com/JLGIndustriesInc or download

the free e-book for your tablet at JLG.com/ebook7

JLG. Helping you reach your potential.

DELIVERING

UNDER PRESSURE