17

FEBRUARY 2014

ACT

BUSINESS NEWS

AUTHOR:

CHRIS SLEIGHT

is

one of the world’s most

internationally renowned

construction business writers,

with specialist expertise in

financial markets and stock

market analysis. He is editor

of KHL’s market-leading

International Construction

and

is a regular contributor to

ACT’

s sister publication,

International Cranes

and Specialized

Transport

.

The New Year saw

stock markets

reach record

highs, despite the

announcement

that the Fed

would phase-out

QE in 2014. So

what will it take

to break up the

party?

Chris

Sleight

reports.

T

he Fed’s Christmas

present to the

markets was its

announcement that it would

phase-out its policy of

quantitative easing (QE) over

the course of 2014 – ‘tapering’

as it has become known.

This is a policy that has seen

some $85 billion per month

– $1,020 billion per year –

being used to buy-up assets

to stimulate the economy. It

is equivalent to printing new

money to invest in assets, but

in fact the money is created

at the push of a computer key,

so the Fed has not even had to

pay-out for ink and paper.

The $1,020 billion that

has been spent annually

throughout the crisis years

is equivalent to about 5

percent of American GDP.

Unsurprisingly the prospect

of this money being pulled

out of the economy has got

some investors worried.

However, the Fed has said

that it will reinstate QE if data

shows tapering to be hurting

economic growth and job

creation.

And despite the news of the

end of QE, stock markets were

in festive high spirits as 2013

came to a close. The Dow

moved back above 16,000

points over the Christmas and

New Year period, and spent

the first few days of January

setting new record highs in

16,500-point territory.

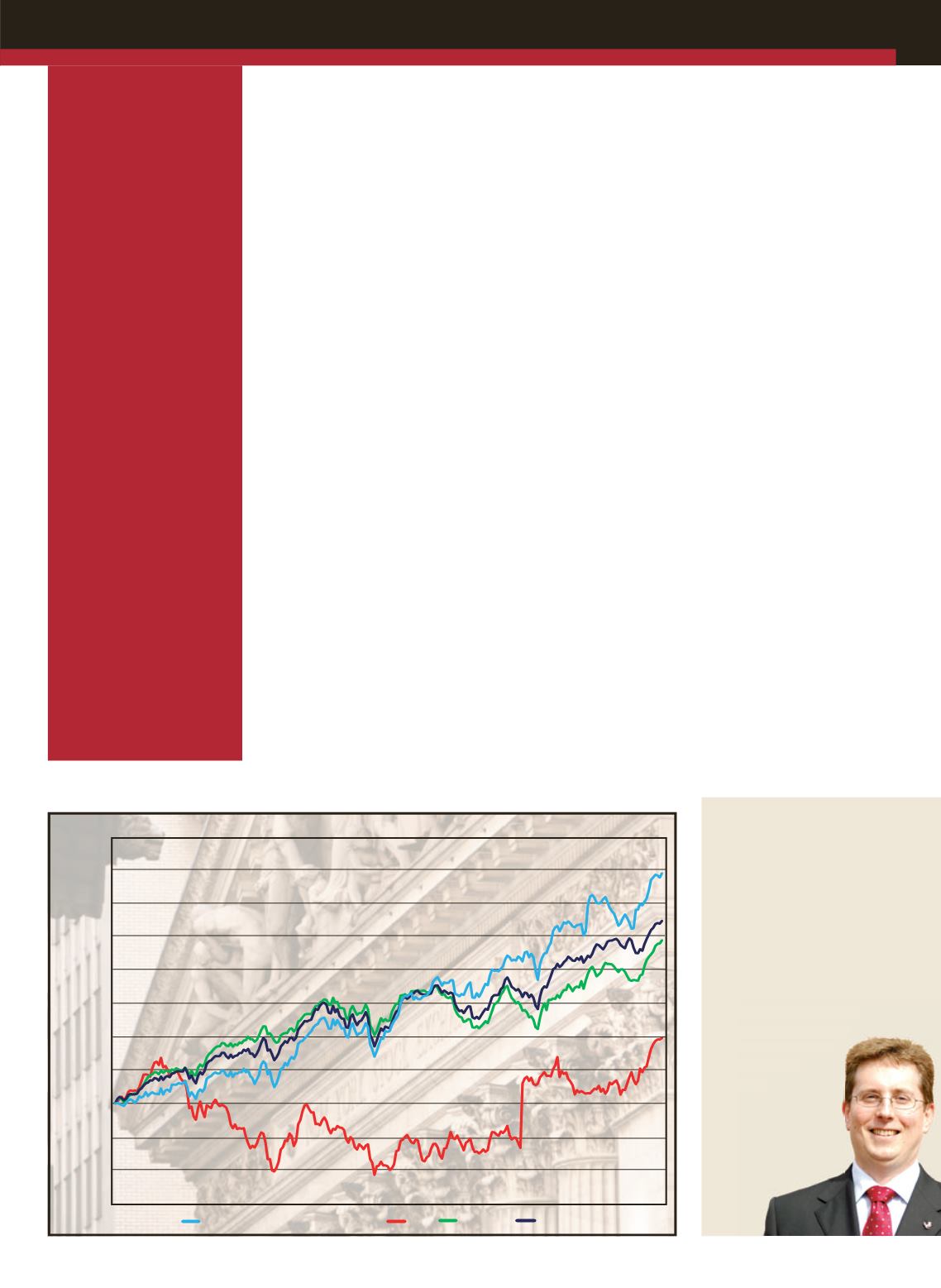

As our graph shows, the

heavy equipment sector saw

some benefit from the year-

end and New Year rally, with

a steep climb in line with the

wider markets. However, it’s

longer-term performance over

the last 12 months has been

disappointing, with weak

market conditions around the

world hitting sales and profits.

The good news is that both

domestic and international

economic growth is expected

to be stronger this year than

in 2013. It may need to be.

The remarkable 25 percent

to 35 percent growth of

mainstream indicators like the

Dow, NASDAQ and S&P 500

this year means that sooner

or later investors are going to

start taking profits.

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P 500

40%

35%

30%

25%

20%

15%

10%

5%

0%

5%

-10%

-15%

% change

52 weeks to January 2014

Stronger economic growth

this year may also mean that

the appetite for risk and more

diverse investments increases.

Again, this will probably pull

indexes like the Dow down,

as money is taken from these

relatively safe havens, and put

to work in areas of greater

potential risk and return.

So perversely, it may be that

a stronger economy this year

will lead to a stock market

slump.

There are also seasonal

factors to consider. Markets

traditionally rally towards the

end of the year and on into

January, with the year-end

results season, which starts in

earnest in the fourth week of

the year, usually serving to as

a reality check.

So while it is positively

foolhardy to make market

predictions in the current

climate, experience would

suggest that the highs that

have been set in the first

few weeks of the year will

probably stand for several

months at least, if not much

longer.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’s most

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

What hangover?