17

JULY 2013

ACT

BUSINESS NEWS

AUTHOR:

CHRIS SLEIGHT

is one of

the world’s most internationally

renowned construction

business writers, with

specialist expertise in financial

markets and stock market

analysis. He is editor of KHL’s

market-leading

International

Construction

and is a regular

contributor to

ACT’

s

sister publication,

International Cranes

and Specialized

Transport

.

Stock markets

retained their

record highs

as the summer

progressed

but the heavy

equipment

industry left the

party early.

Chris

Sleight

reports.

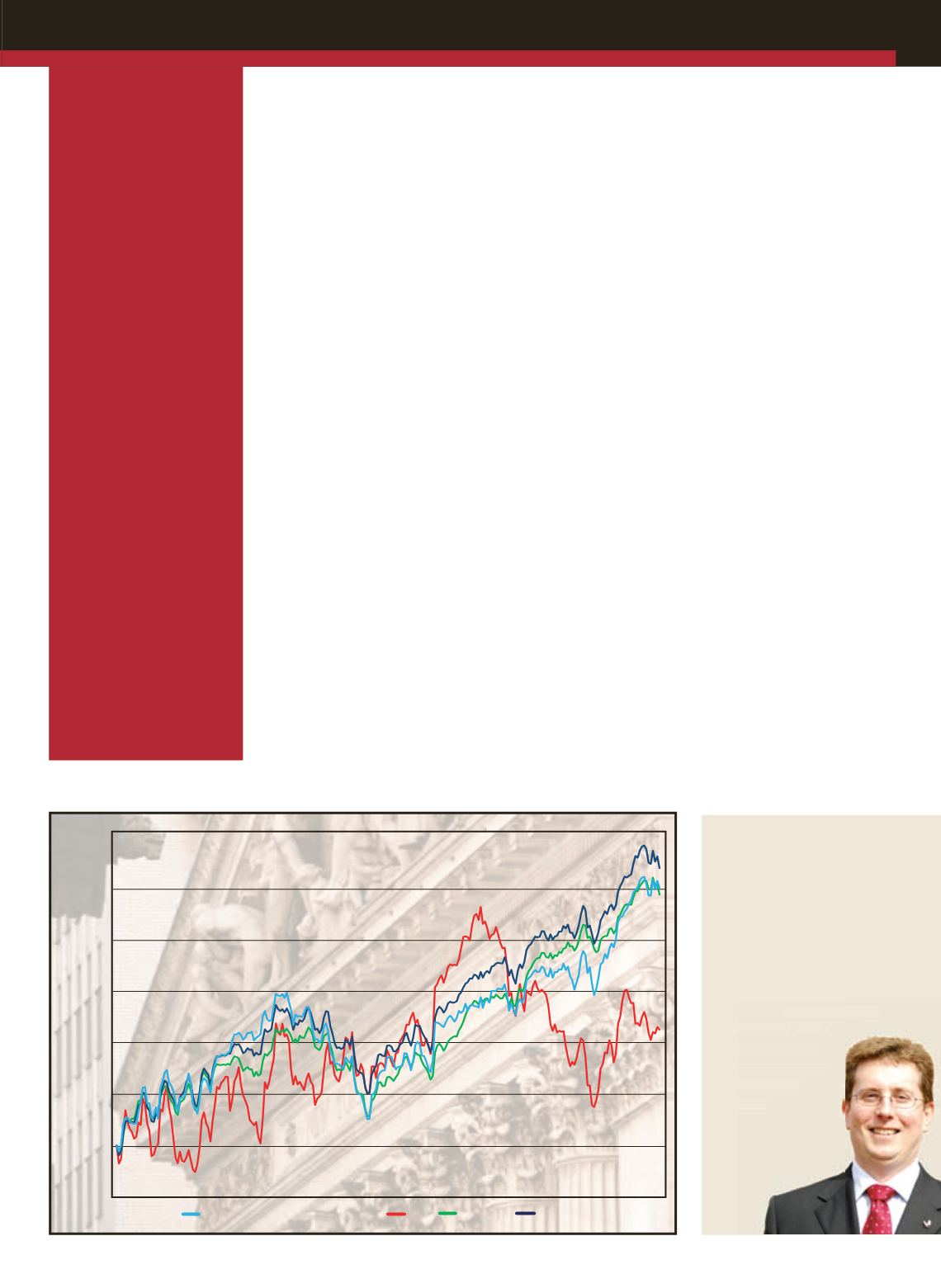

T

he Dow remained

at historic highs

above 15,000 points

for most of June and on into

July. Although there were a

few wobbles as

ACT

went to

press, there was no sign of

the sort of significant fall that

might be expected as a result

of profit taking.

While the Dow has led

the way – it is up almost 30

percent from its position a

year ago – other American

market indicators have not

been far behind. Both the

NASDAQ and S&P 500 have

seen gains of the order of 25

percent over the last year.

The NASDAQ has been

particularly impressive over

the longer term. It is now

some 160 percent higher

than its low point during the

depths of the crisis in early

2009. In comparison, the Dow

is up about 125 percent and

the S&P 500 is up by a similar

margin.

Although the

ACT

HEI’s

long-term recovery has been

even more impressive – by

early June it was some 240

percent higher than its 2009

low – its recent performance

has been disappointing.

There have been some gains

over the last 12 months, but

the index for heavy equipment

manufacturers’ shares has

missed out on a lot of the

growth enjoyed by the major

benchmark indicators like the

Dow, S&P 500 and NASDAQ.

While these are up 25 to 30

percent compared to a year

ago, the

ACT

HEI’s gain is

only about 10 percent and the

last three months have been

particularly disappointing.

Different drivers

But this is not to say that

the companies which

make up the

ACT

HEI are

underperforming or failing in

any way, more that there are

different factors at play. The

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P 500

30%

25%

20%

15%

10%

5%

0%

-5%

% change

52 weeks to June 2013

key reason that the Dow

et

al

have prospered is the lack

of other suitable safe haven

investments.

Interest rates and bond

yields are low, gold is falling

and so it is only really blue-

chip stocks that offer investors

a return at reasonably low

risk.

So in fact it could be argued

that the

ACT

HEI reflects a

more realistic picture of the

domestic and global economy.

Yes, there is growth out

there and the dark days of

the recession and potential

collapse of the Euro-zone are

behind us, but neither the

American or key developing

world economies are about to

shift up into another gear of

high growth, as was seen in

2003 to 2007.

The outlook is not bleak

by any means, and it should

continue to improve, but there

is no sign of another boom on

the horizon.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’s most

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Equipment

sector subdued