FINANCE

13

CONSTRUCTION EUROPE

OCTOBER 2013

Delaying the

inevitable

A spurt in stock

markets around

the world in

September took

the European

construction

sector to its

highest for more

than two years.

Chris Sleight

reports

T

he statement from the US

Federal Reserve in mid-

September that it would

continue its quantitative easing

(QE) stimulus programme gave

stock markets around the world

fresh impetus.

The European construction

sector enjoyed a broad rally along

with the other equities, taking

the CET Index to its highest level

since May 2011.

PriortotheFed’sannouncement

on September 18, there had been

concerns that it would start to

wind-down the QE programme,

which currently sees it buy-up

bonds and other assets at a

rate of some US$85 billion (€63

billion) per month.

However, Federal Reserve

chairman Ben Bernanke said

he would delay the so-called

tapering

of

QE

because

unemployment in the country

was still high. In addition,

congress was squabbling over

forthcoming budget deadlines

and mortgage rates were rising.

Although the markets will

have to come to terms with the

gradual turning-off of the QE tap

at some point, September’s news

provided something of a boost.

The Dow jumped back above

the 15,000-point market to finish

week 38 at 15,451 points, a 3.26

improvement on its position four

weeks earlier.

The FTSE 100 was more

subdued with a 2.20% rise, while

other European indicators, the

DAX and CAC40 for example,

were more bullish with 3.34%

and 4.23% rises respectively.

Most striking of all was the 7.92%

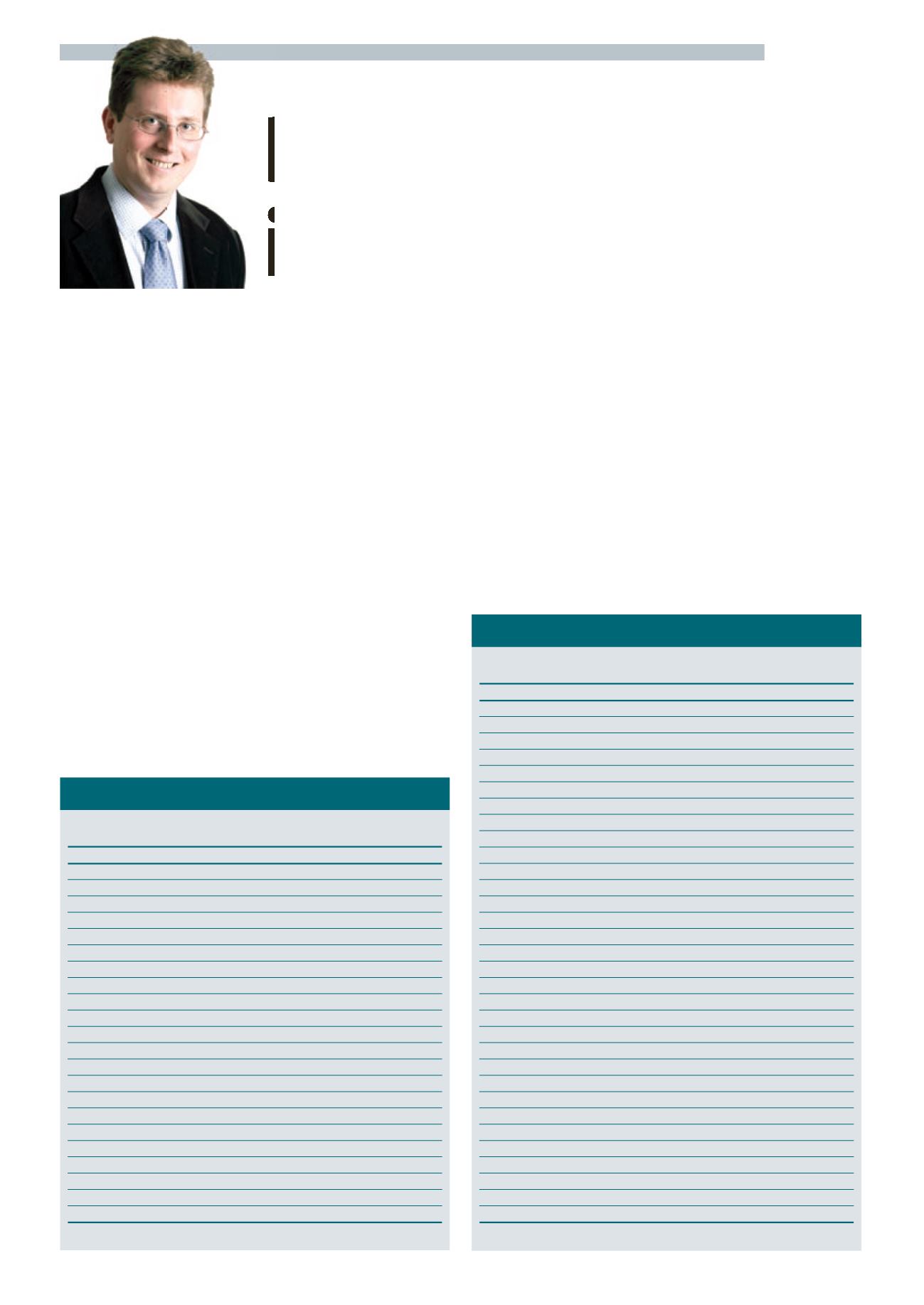

Company

Currency Price

Price Change Change

at start at end

(%)

CEC Index

138.99 147.51

8.52

6.13

Acciona

€

40.20

41.79

1.59

3.96

ACS

€

22.42

23.50

1.08

4.82

Astaldi

€

5.86

6.30

0.44

7.60

Balfour Beatty

UK£

2.515

2.777

0.262

10.42

Ballast Nedam

€

11.45

12.10

0.65

5.68

Bam Group

€

3.70

3.80

0.10

2.68

Bauer

€

18.41

18.23

-0.18

-0.98

Bilfinger

€

72.88

75.43

2.55

3.50

Bouygues

€

23.67

26.95

3.28

13.86

Carillion

UK£

2.881

3.170

0.29

10.03

Eiffage

€

44.04

40.99

-3.05

-6.93

FCC

€

13.95

14.25

0.30

2.15

Ferrovial

€

13.13

13.37

0.24

1.83

Hochtief

€

55.14

62.38

7.24

13.13

Impregilo

€

3.44

3.46

0.02

0.64

Keller Group

UK£

11.100 10.770 -0.330

-2.97

Kier

UK£

14.916 16.510 1.594

10.69

Lemminkäinen

€

15.02

15.20

0.18

1.20

Morgan Sindall

UK£

6.835

7.405

0.570

8.34

Mota Engil

€

2.74

2.87

0.13

4.90

NCC (B)

SEK

171.70 191.10 19.40

11.30

OHL

€

27.43

28.34

0.91

3.32

Peab (B)

SEK

36.89

38.70

1.81

4.91

Sacyr Vallehermoso

€

2.92

3.45

0.53

18.28

Skanska (B)

SEK

122.30 126.90

4.60

3.76

Strabag SE

€

17.33

18.49

1.16

6.69

Taylor Wimpey

UK£

1.046

1.019

-0.027

-2.60

Tecnicas Reunidas

€

34.23

35.52

1.29

3.77

Trevi Group

€

6.28

6.40

0.12

1.91

Veidekke

NOK

46.00

47.00

1.00

2.17

Vinci

€

40.28

43.10

2.82

7.00

YIT

€

10.83

10.59

-0.24

-2.22

Period: Week 34 - 38

rise for the Nikkei 225 in Japan,

which also enjoyed something

of a lift with the news that Tokyo

had been selected to host the

2020 Summer Olympics.

Against this backdrop the

European construction sector

performed well. The CET Index

for the whole industry was

up 6.18%, and the gains were

evenly spread across three

sectors. Contractors’ shares were

up 6.13%, as measured by the

CEC Index, materials producers

(CEM Index) were up 6.17% and

equipment manufacturers in the

CEE Index saw a 6.21% gain.

Such a broad and concerted

CONTRACTORS

EQUIPMENT MANUFACTURERS

Company

Currency Price

Price Change Change

at start at end

(%)

CEE Index

239.86 254.76 14.90

6.21

Astec Industries

US$

35.47

36.36

0.89

2.51

Atlas Copco (A)

SEK

179.70 190.70 11.00

6.12

Bell Equipment

ZAR

23.00

23.30

0.30

1.30

Caterpillar

US$

84.17

84.75

0.58

0.69

CNH

US$

48.63

48.44

-0.19

-0.39

Deere

US$

83.25

83.82

0.57

0.68

Doosan Infracore

WON

14000

16900

2900

20.71

Haulotte Group

€

7.07

8.87

1.80

25.46

Hitachi CM

YEN

1997

2343

346

17.33

Hyundai Heavy Industries

WON 217500 266000 48500

22.30

Kobe Steel

YEN

161

179

18

11.18

Komatsu

YEN

2245

2572

327

14.57

Kubota

YEN

1365

1555

190

13.92

Manitou

€

10.55

12.20

1.65

15.64

Manitowoc

US$

21.17

20.04

-1.13

-5.34

Metso

€

29.32

31.20

1.88

6.41

Palfinger

€

25.50

26.15

0.65

2.57

Sandvik

SEK

88.10

93.85

5.75

6.53

Tadano

YEN

1440

1460

20

1.39

Terex

US$

30.97

34.37

3.40

10.98

Volvo (B)

SEK

97.95

103.00

5.05

5.16

Wacker Neuson

€

10.60

10.57

-0.03

-0.28

Period: Week 34 - 38

>