29

NOVEMBER 2013

ACT

MEXICO

REGIONAL REPORT

training employees to perform needed

skills becomes a priority. New business

will be attracted because of improving

labor capabilities.

Velasco’s company provides all relocation

services except for trucking. However,

it arranges and coordinates trucking for

customers.

“We don’t see any economic problems

ahead,” Velasco speculates. “If the U.S.

economy suffers a setback, it would affect

Mexico. It might not be as proportionally

strong, but there would be some impact.”

Increase from Pemex?

Ervin’s Connor says that a Pemex

spending increase might come in 2014’s

first quarter.

“I understand that Pemex needs and

wants to do a lot of upgrading,” he says.

“For us, that would result in a big increase

in heavy hauling.”

Connor speculates that projects would

come on three tiers: direct business with

Pemex; work with energy giants like

Halliburton and Schlumberger that office

in Mexico; as well as mid-size and smaller

companies that serve Pemex.

Since 2004, Mexico’s oil production

has fallen from 3 million barrels a day

to 2.5 million. Part of the problem is

that the government shares Pemex

profits. Reforms might permit Pemex to

assign some of those profits back into its

exploration and production work. That

revenue would spur more projects with

foreign companies that provide equipment

and subcontract drilling-rig operations.

Mexico’s constitution permits partnerships

with foreign companies but prohibits

ownership of Mexico operations.

Matt Hinds, who directs Ervin’s

operations from two suburban Mexico

City locations, remains optimistic.

“Mexico’s congress is considering the

president’s reforms,” Hinds says. “There

will be reforms. We just don’t when they

will come. I don’t expect them all to

happen at once. If some reforms pass in

December and January, there will probably

be more in the months ahead.”

Some have speculated that as

government attempts to diversify business,

there would be less dependence on

Pemex profits. “That would be a good

thing,” Hinds says. “There would be more

profit that Pemex could put back into

exploration and production. That would

mean more opportunities for companies

serving Mexico’s energy business. By 2016,

Mexico hopes to get oil production back

to 3 million barrels a day.”

That hasn’t happened in almost a decade.

“I think the president’s reforms could

spark a business boom in Mexico,”

Tradelossa’s spokesman says. “Fiscal

reforms could be a major improvement.

There would be private-sector incentives

that would change the framework of how

Mexico does its work. Some people think

the approval of these reforms is taking too

long. But right now, all we can do is sit and

wait for them.”

■

a sharp increase in business beyond the

Americas. Business would also perk up for

South Korean, Spanish and other Asian

and European nations doing business in

Mexico.

Mexico’s economic future persuaded AK

Industrial Contractors to create a second

company there. Founded in 1981, the

U.S. company created AK Contratistas

Industriales 17 years later in Monterrey.

Both companies enjoy sustained

prosperity. Little change is on the horizon,

according to Velasco. He commutes

between the U.S. and Mexico. He sees

no interruption in his company’s steady

requests for relocation and reinstallation.

As companies move to Mexico to reduce

costs, Velasco says, “We’ve been able to

fit our skills to the jobs that relocating

companies need. There has been a

consistent demand for our services. We

expect that steady demand to continue

for 2014. We don’t anticipate the peaks

or valleys that we used to experience in

Mexico.”

Velasco identifies one trend that can

generate even more maturity in Mexico’s

economy.

“As regions of Mexico increase their

number of workers and the skills of

those workers, growth will advance in

those regions,” he says. “Growth won’t

necessarily happen just in big cities, which

is the way it used to be.”

When a region or state focuses on

specializing in automotive, paper

manufacturing or aerospace work,

LEFT: Tradelossa hauled an extremely long

and heavy oil refinery chimney from a

manufacturing facility in Monterrey, Mexico

to Tula’s Oil Refinery.

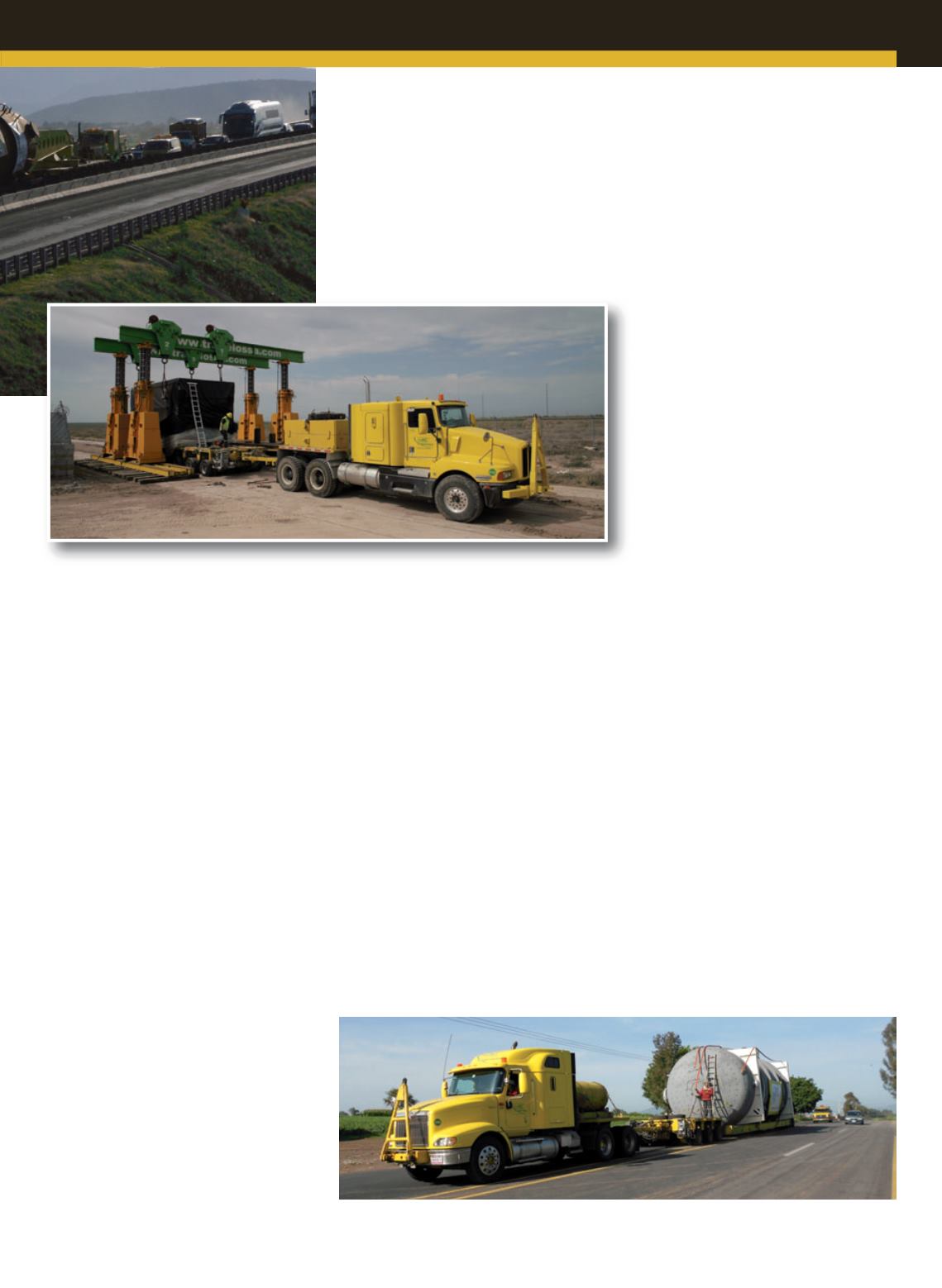

BELOW: Tradelossa’s business has been

strong in 2013 and the company anticipates

more work in 2014, especially if government

reforms are enacted. Reforms could spark a

business boom in Mexico, the company says.

Tradelossa has invested in transportation and rigging equipment to become more competitive

in hauling projects.